Quick Summary: OneCard, a unique metal credit card, offers benefits like rewards on everyday purchases and NO annual fees! It's easy to manage online and keeps your transactions secure. To qualify, you'll need to be 18+ with a decent credit score (ideally above 700) and income proof. Secured options are available for those who don't meet the criteria. Remember, responsible credit card usage is key!

Introduction

Are you tired of boring plastic credit cards? Looking for a card that offers rewards, convenience, and a touch of luxury? Then the OneCard review might be just what you need!

In this comprehensive post, I’ll delve into everything you need to know about the OneCard, a unique metal credit card offered by OneCard.

We’ll explore its OneCard features, OneCard benefits, OneCard eligibility criteria, and more.

By the end, you’ll be able to decide if the OneCard is the right fit for you.

Also Read: Moneytap Review || Is it Real Or, Fake?

What is OneCard?

OneCard is a unique metal credit card offered in India by OneCard.

It stands out for its reward program, no annual fees, zero hidden charges, easy online management, and secure transactions.

Also Read: Navi Loan App Review: Pros & Cons: Is it legit?

OneCard Review: Banking Partners

OneCard is a co-branded credit card issued by several Scheduled Commercial Banks and Financial Institutions.

These banking partners play a crucial role in issuing and managing the OneCard for its users.

Here’s a list of the current OneCard banking partners:

- Bob Financial

- CSB Bank

- Federal Bank

- IDFC FIRST Bank

- SBM Bank

- South Indian Bank

- Indian Bank

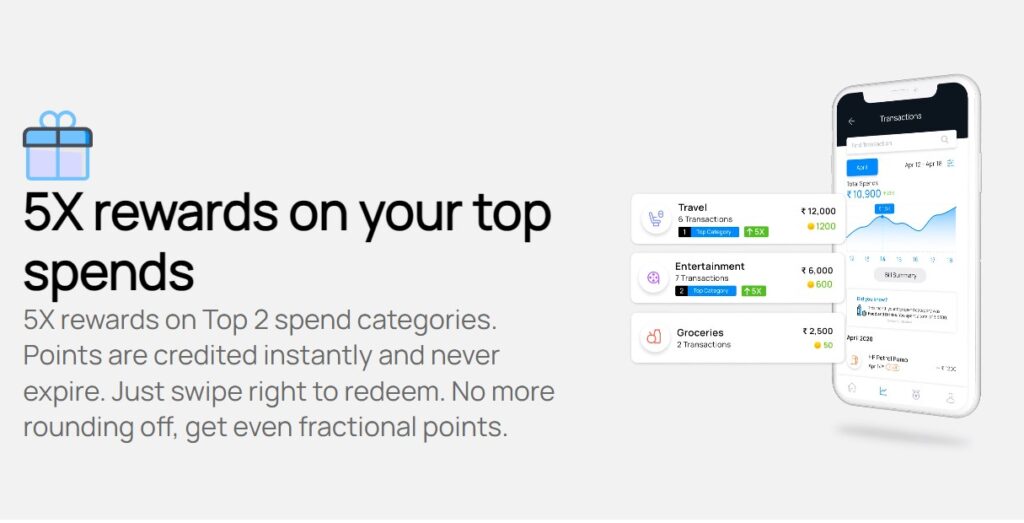

Rewards: OneCard has a rewards program where users earn 1 reward point for every INR 50 spent, with an accelerated 5x reward points on top 2 spend categories each month

OneCard Review: Key Features

The OneCard stands out with its unique metal design, offering a premium and sturdy feel compared to traditional plastic cards. But its features go beyond aesthetics:

- Reward Program: Earn 5X reward points on your top 2 spending categories each month, and 1 point for every Rs. 50 spent elsewhere. Redeem points for exciting rewards like vouchers, travel, and merchandise.

- No Annual Fee: Enjoy a completely fee-free experience with no annual, joining, or renewal charges.

- Zero Hidden Charges: Unlike some cards, the OneCard boasts complete transparency with no hidden fees or charges.

- Easy Online Management: Manage your card conveniently through the user-friendly OneCard mobile app.

- Secure Transactions: Enjoy peace of mind with advanced security features like chip-and-PIN technology and transaction alerts.

Eligibility: The card is available in variants based on credit score as either FD Secured Limit or Direct Credit Limit, catering to different user profiles

OneCard Review: Benefits Explained

While the OneCard features are impressive, the real value lies in the One Card benefits:

- Rewards on Every Purchase: Whether you’re grocery shopping or fueling your car, you’ll always earn points with the OneCard.

- Save Money on Annual Fees: Compared to cards with annual fees, the One Card can help you save money in the long run.

- Budgeting Made Easy: Track your spending easily through the mobile app and identify your top spending categories to manage your finances effectively.

- Convenience at Your Fingertips: Manage your card, redeem points, and get real-time updates, all from your phone.

- Peace of Mind with Security: Shop with confidence knowing your card is protected by advanced security features.

ATTENTION!! While OneCard heavily promotes its "no annual fees" benefit, it's not technically "lifetime free." There are other potential charges like late payment fees, overlimit fees, and foreign transaction fees.

OneCard Review: Fees & Charges

Here is a breakdown of the fees and charges associated with OneCard:

| FEE | DESCRIPTION | COST |

| Annual Fee | Yearly charge for holding the card | Rs. 0 (No annual fee) |

| Joining Fee | One-time fee charged when you apply and get approved | Rs. 0 (No joining fee) |

| Renewal Fee | Fee charged at the end of the card’s validity period for renewal | Rs. 0 (No renewal fee) |

| Late Payment Fee | Penalty charged for delayed payments | 2.5% of the total outstanding amount (minimum Rs. 125) |

| Overlimit Fee | Charge for exceeding your credit limit | 2.5% of the overlimit amount |

| International Transaction Fee | Markup applied on transactions made in foreign currency | 3.5% of the transaction value |

| Cash Advance Fee | Fee charged for withdrawing cash using your card at an ATM | 2.5% of the transaction value (minimum Rs. 100) |

| Lost Card Replacement Fee | Charge for replacing a lost or stolen card | Rs. 200 |

| GST | Goods and Services Tax applicable on all applicable fees | As per prevailing rates |

OneCard Review: Eligibility and Application

Before applying for the One Card, it’s crucial to understand the OneCard eligibility criteria:

- Minimum Age: You must be 18 years old to apply.

- Income Proof: Salaried and self-employed individuals may apply. You may be asked to submit proof of income, such as salary slips or bank statements.

- Credit Score: While the specific credit score criteria is unknown, a good credit score (ideally above 700) may be advantageous for obtaining an unsecured OneCard.

- Secured Option: If you do not fulfill the eligibility requirements for an unsecured card, you can obtain a secured OneCard by making a set deposit with a partner bank.

Also Read: Namita Thapar || An Inspiring Story

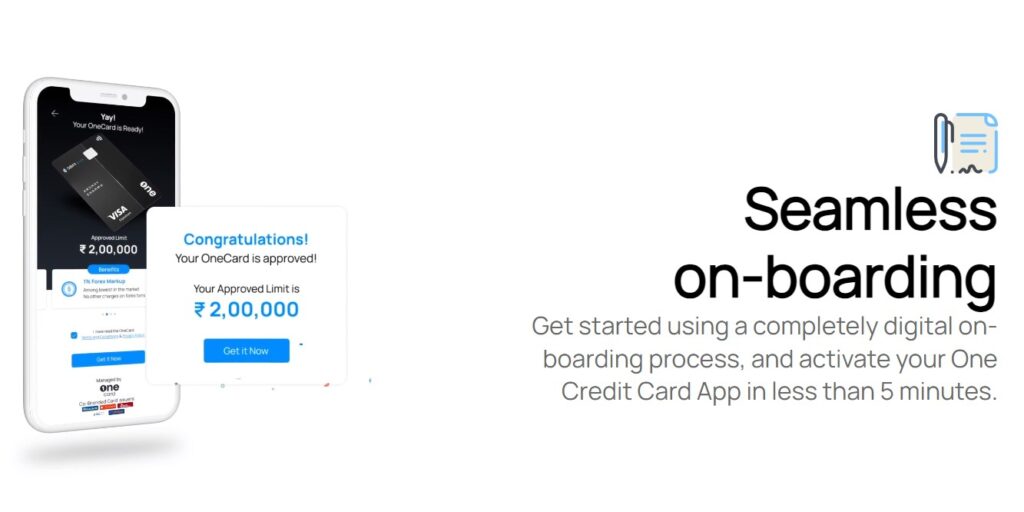

OneCard Review: Sign Up Process

Applying for a OneCard is a simple and online-only process:

- Head over to the OneCard website or App.

- Click on “Apply Now“.

- Fill out the online application form with your personal details, income information, and contact information.

- Upload any required documents as requested.

- Submit your application and wait for a response.

OneCard generally processes applications and makes decisions quickly.

You’ll be notified via email or phone call about the status of your application.

But, hold on, before moving further consider the following points also:

- Before applying, check the pre-approved offer section on the OneCard website or app. This can help you see if you qualify for a card without a formal application.

- Review the terms and conditions carefully before applying to understand any limitations or fees associated with the card.

- Only apply for a credit card that aligns with your financial needs and spending habits.

Remember, responsible credit card usage is key to building a healthy financial future!

FEES: It has zero joining and annual fees, making it a lifetime free credit card

OneCard Review: Rewards & Offers

Reward Program

- Earn points: You earn 5X reward points on your top 2 spending categories each month, and 1 point for every Rs. 50 spent elsewhere.

- Top spending categories: These categories are automatically determined based on your previous month’s spending and can include groceries, dining, travel, etc.

- No limit: There’s no cap on the number of reward points you can earn.

- No expiry: The points you earn never expire, allowing you to accumulate them over time

Redemption Options

- Statement credit: Adjust your credit card statement by redeeming points for their equivalent value in rupees.

- Gift vouchers: Choose from a wide range of gift vouchers for popular brands and online retailers.

- Travel: Redeem points for flight bookings and hotel stays through partnered travel platforms.

- Merchandise: Use your points to purchase merchandise from various categories.

Also Read: Best Banks For Salary Account In India || Benefits

OneCard Review: Pros & Cons

Pros of OneCard

- Reward program: Earn on everyday spending

- Unique metal design: Premium and sturdy feel

- No annual fees: Enjoy a completely free experience

- Zero hidden charges: Transparent pricing with no surprises

- Easy online management: Convenient mobile app for managing your card

- Secure transactions: Advanced security features for peace of mind

Cons of OneCard

- Limited redemption options: Compared to some established cards

- Newer player: OneCard has a shorter market track record

- Credit score requirement: Securing an unsecured card might require a good score

- Secured option requirement: Fixed deposit needed for those not meeting unsecured card criteria

Also Read: Cred Review: Is Cred App Safe to Use

User Experience

My buddy Rahul, an IT executive, recently described an epiphany – his discovery of OneCard. Like many urban professionals juggling manifold credit options, he felt enslaved by a chaotic maze of annual fees, redemption rules, and paperwork. However, Rahul claims OneCard granted liberation from this complex credit labyrinth.

Firstly, Zero Annual Fees reflected accessibility, upfront pricing without unpleasant surprises delighting Rahul’s practical sensibilities. Additionally, the rewards program’s transparent construction impressed hugely, particularly 5X points on his two monthly spending sweet spots and accumulating timeless points.

Moreover, multiple redemption avenues – travel, merchandise, subscriptions offered flexibility along with accentuated earnings potential from personalized spending. Tracking benefits through the intuitive app also won applause as Rahul felt empowered by customized insights into spending patterns.

Additionally, frequent discount coupons help Rahul save on entertainment and online shopping – further maximizing value. But most importantly, he feels OneCard has decluttered his financial life, blending rewards with fuss-free features through an effortless app-based interface.

So if you seek a seamless card merging lucrative deals with transparency, Rahul enthusiastically endorses OneCard as a catalyst that would spark a rewarding simplicity into your life.

According to him, this card could be a real game changer for credit users in India.

Also Read: P2P Lending In India- A Complete Guide

Conclusion

As a personal finance professional with over 15 years of experience, I appreciate the OneCard’s transparency, zero hidden charges, and focus on rewarding everyday spending.

However, it’s important to consider your individual financial goals and spending habits before making a decision.

If you’re looking for a rewarding and convenient card with a unique metal design and no annual fees, the OneCard is definitely worth considering.

Remember, responsible credit card usage is key to building a healthy financial future!

Also Read: HDFC Sky Review | Brokerage Charges, Free Demat A/c

FAQs

Is OneCard real or fake?

OneCard is a real metal credit card designed for the mobile generation, offered by FPL Technologies in collaboration with various banks.

It is a lifetime free card with no joining or annual fees, featuring a low forex markup of 1%.

OneCard has a feature-rich mobile app, allows credit limit sharing with family members, and offers rewards points on spending.

The company is committed to data security, holding ISO/IEC 27001:2013 and PCI-DSS V 3.2.1 certifications.

Which bank issues OneCard?

OneCard is a metal credit card developed for the modern customer and marketed by FPL Technologies in partnership with various institutions such as SBM Bank, South Indian Bank, Federal Bank, and BOB Financial.

It is an entry-level credit card with a 0.2% to 2% reward rate, no annual fee, and a small markup fee of 1% + GST.

OneCard is excellent for people who wish to experience the metal form factor and the minimal markup cost, which are exclusively available on hyper premium credit cards.

The card is currently available in 15 cities, including Pune, Mumbai, Bangalore, Ahmedabad, Baroda, Surat, and Delhi, with plans to extend to other cities soon.

Is OneCard safe to use?

OneCard prioritizes security with features such as chip-and-PIN technology and transaction alerts.

They also offer a metal card, which is more durable than plastic and may reduce the danger of physical damage or skimming.

However, remember that, like any credit card, safe and responsible use is essential.

Always keep your PIN private, keep an eye out for odd activity on your statements, and report any issues as soon as possible.

What are disadvantages of OneCard?

OneCard has some drawbacks to consider before opting for it:

- Low Reward Rate: One of the major downsides of OneCard is its extremely poor rewards program, offering a meager 0.2% reward rate on regular spending, which is one of the lowest in the segment.

- No Lounge Access: Unlike many credit cards, OneCard does not provide any airport lounge access, which can be a significant downside for frequent travelers.

- Limited Availability: OneCard is currently available only in limited cities, restricting its usability for individuals residing outside these locations.

Is OneCard lifetime free?

While OneCard heavily promotes its “no annual fees” benefit, it’s not technically “lifetime free.”

There are other potential charges like late payment fees, overlimit fees, and foreign transaction fees.

So, while you won’t pay an annual fee just for having the card, responsible use is key to avoid any additional costs.

Remember, even “free” cards can come with charges if not used wisely!

Can we use OneCard in ATM?

Yes, you can use OneCard at ATMs for cash withdrawals.

However, it is important to note that OneCard is primarily a credit card, so using it at ATMs will incur cash withdrawal fees and interest charges from the day of withdrawal until the amount is repaid.

It is advisable to use credit cards primarily for purchases to avoid unnecessary fees and interest expenses.

My Social Links: Quora, Facebook, Linkedin, Pinterest, X (Twitter)