Introduction

Before diving deep into P2P lending in India, lets first understand what p2p lending is!

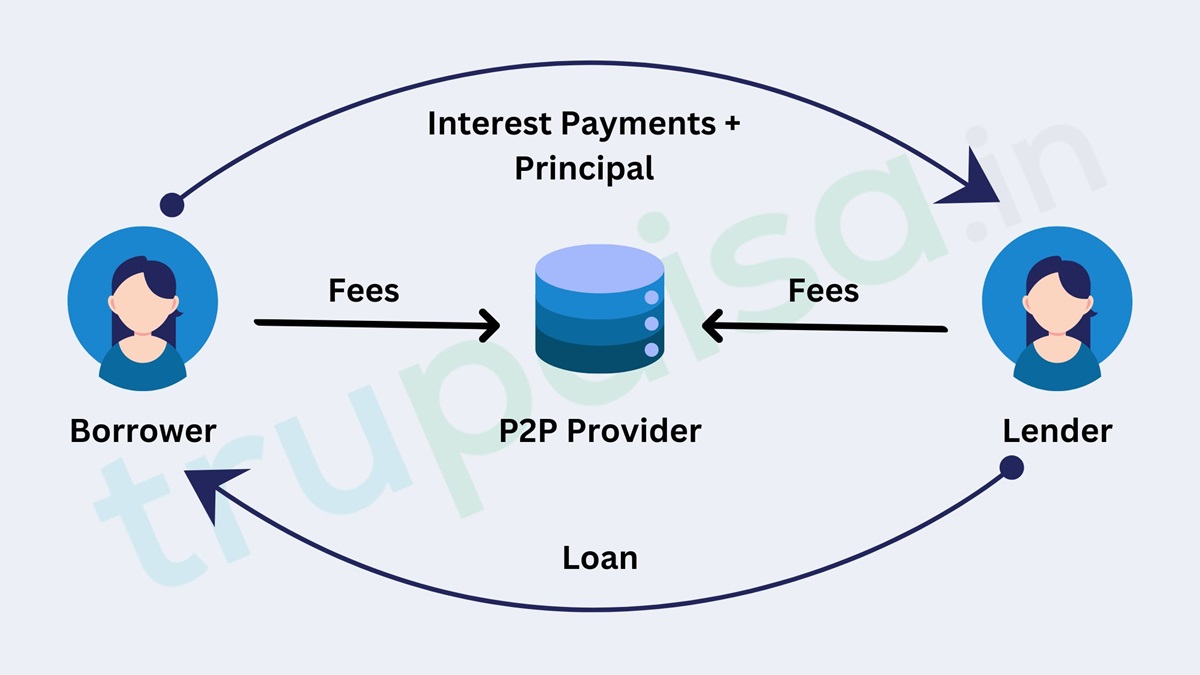

P2P stands for peer to peer. In P2P lending borrowing and lending happens among borrowers and lenders directly, without intervention of a traditional financial institution such as bank or a NBFC.

It offers a dynamic and inclusive platform both for borrowers and investors.

P2P lending offers credit to the underserved and investment options for the risk-takers. A win-win situation for both borrowers and lenders.

Because of this, Peer-to-Peer (P2P) lending has completely transformed the India’s financial landscape.

In this article, we will delves into the P2P lending landscape in India, its advantages, disadvantages, associated risks, regulations around it, its potential to generate passive income for investors & its future prospects.

ALSO READ: 12% Club Review- Features, Advantage & Disadvantages

How P2P Lending Works

Imagine P2P platforms as a bustling & kicking online marketplace where borrowers with specific needs connect directly with lenders seeking investment opportunities.

Generally, P2P lending facilitates direct lending between individuals without the involvement of traditional financial institutions.

Borrowers connect with lenders through online platforms, creating a decentralized lending ecosystem.

With technological advancements in data analytics and risk assessment, accuracy of credit evaluations has been improved dramatically in P2P lending space also.

The platform manages the money flow, ensures repayments, and provides a transparent ecosystem for everyone involved.

P2P platforms like Faircent, Lendbox, and Indiabulls Dhani streamline this process, acting as facilitators and risk assessors.

Borrowers, seeking funding for personal or business needs, create loan listings detailing their requirements. Lenders, comprising individuals or institutional investors, review these listings and choose where to invest based on risk profiles and potential returns.

The lending process involves application, approval, fund transfer, and repayment. P2P platforms use algorithms and credit scoring to assess borrower risk, ensuring informed lending decisions.

ALSO READ: Best Neo Banks In India- A Personal Guide

ALSO READ: How To Start A Neobank In India? A Complete Guide

P2P lending market size in India

The peer-to-peer (P2P) lending market in India is experiencing significant growth and presents lucrative opportunities for investors.

According to a report by IndustryARC, the Indian P2P lending market is expected to swell to $10.5 billion by 2026, with a projected growth rate of 21.6% between 2021 and 2026.

Benefits for Borrowers

- P2P platforms offer quicker loan approvals, especially for individuals with limited credit history or those seeking smaller loan amounts. There is no need to do a difficult paperwork and multiple visits to your bank. The entire process is well streamlined.

- Besides this, there is no need to pay the sky-rocketing interest rate to avail the required loan, especially for a borrower having poor credit score. P2P platforms connect borrowers directly with lenders, leading to more competitive interest rates. Additionally, borrowers enjoy greater flexibility in choosing loan tenures and repayment schedules.

- Because of this, borrowers tend to pay responsible through P2P. This will positively impact your credit score, opening doors to more favourable loan terms in the future.

Benefits for Lenders

- P2P is equally beneficial for lenders also. As a lender, if you act as a private money-lenders, there is a lot of risk involved in it. On the other hand, fixed deposit offer non-lucrative returns. Whereas, P2P offers the potential for significantly higher returns on your investments compared to traditional options. Investment in a diversified portfolio of P2P loans has a potential to offer lenders a steady stream of passive income.

- Lenders, by participating in P2P lending, can contribute to empowering underbanked individuals and businesses, fostering financial inclusivity in India. Could be a great service to a great nation called Bharat!

- Lenders has a choice to choose loans that align with their risk appetitive/ tolerance and investment goals. Most of the P2P platforms provide extensive borrower information and track records. This empowers you to make informed decisions & make lucrative returns.

- Lenders can diversify their investment portfolios thus reducing their risk.

ALSO READ: Is Kotak 811 a Neo Bank in India?

ALSO READ: Is Google Pay a Neo Bank?

Regulatory Landscape In India

The much-required credibility and stability to the P2P lending space has been introduced by the NBFC-P2P regulations in 2017.

P2P lending in India is strictly regulated by the Reserve Bank of India (RBI).

The guidelines issued by RBI aim to protect the interests of both borrowers and lenders, outlining operational norms and risk management strategies for P2P platforms.

P2P platforms are required to comply with strict Know Your Customer (KYC) norms, maintain escrow accounts, and adhere to regulations regarding the permissible loan amount for a single lender or borrower.

Regulations have instilled trust in the P2P lending sector, making it a more secure option for borrowers and lenders. Compliance measures have played a crucial role in the industry’s growth and stability.

Risks In P2P Lending In India

Peer-to-peer (P2P) lending has emerged as a popular alternative to traditional lending in India. However, like any investment, P2P lending comes with risks that investors should be aware of.

Here are some of the risks associated with P2P lending:

- Credit risk: P2P loans are exposed to high credit risks. Many borrowers who apply for P2P loans possess low credit ratings that do not allow them to qualify for traditional loans. This increases the risk of default, which can lead to a loss of investment.

- Concentration risk: Not enough diversification can lead to a concentration of risk in a single borrower or loan. This can increase the risk of loss if the borrower defaults.

- Platform risk: Losing money due to a P2P lending site going bust is another risk associated with P2P lending. If the platform goes bankrupt, investors may lose their investment.

- Regulatory risk: P2P lending is a relatively new industry, and regulations are still evolving. Changes in regulations can impact the returns on investments.

- Liquidity risk: P2P loans are not as liquid as other investments. Investors may not be able to withdraw their investment before the loan term ends.

As with any investment, risk-reward equation in P2P lending space also has to be managed properly.

To mitigate these risks, investors should do a through research before investing in P2P lending.

They should also diversify their investments across multiple borrowers and platforms. Additionally, investors should only invest an amount that they can afford to lose.

Top 8 P2P Platforms in India

Peer-to-peer (P2P) lending has revolutionized the financial landscape in India, offering both borrowers and lenders a refreshing escape from the traditional brick-and-mortar banking system.

But with numerous P2P platforms sprouting up, navigating the options can be overwhelming.

So, giving you the brief idea about the prominent players operating in P2P lending space in Bharat.

1- Faircent

Faircent is India’s first RBI-registered P2P lending platform, providing a virtual marketplace for borrowers and lenders to interact directly.

The platform offers a range of investment options, with returns of up to 12% p.a. for lenders.

Faircent’s stringent borrower verification process, including credit scores, income proofs, and KYCs, ensures guaranteed returns to investors.

The platform’s transparent and secure approach, along with its high returns, has positioned it as a trusted and investor-friendly P2P lending platform in India.

Faircent is recognized in India and the world over for its tremendous potential as a P2P lending platform, with over Rs. 2500 crores loan amount disbursed till date.

2- Lendbox

With over 50,000 investors and 5.4 lakh registered borrowers, Lendbox enjoys immense popularity.

They offer flexible loan terms (12-60 months) for personal, education, and business purposes, with loan amounts ranging from Rs. 10,000 to Rs. 50 lakh and interest rates between 10% and 20% p.a.

Also note that ne of the prominent players in the Indian P2P lending market is “Per Annum” by Lendbox, which offers investors the opportunity to earn up to 12% in annual returns by lending to creditworthy individuals in India

3- LenDenClub

Known for its user-friendly interface and low minimum investment (Rs. 10,000), LenDenClub has attracted over 1 crore customers.

They offer diversified loan options for personal, business, and investment purposes, with loan amounts ranging from Rs. 10,000 to Rs. 50 lakh and interest rates between 9% and 26% p.a.

4- RupeeCircle

Focusing on affordable loans for salaried individuals and small businesses, RupeeCircle offers loan amounts ranging from Rs. 10,000 to Rs. 5 lakh with interest rates between 12% and 26% p.a.

They have a strong credit evaluation process and provide detailed borrower information.

5- i-Lend

Specializing in lending to SMEs, i-Lend offers loan amounts ranging from Rs. 25 lakh to Rs. 5 crore with interest rates between 14% and 20% p.a.

They have a stringent due diligence process and cater to established businesses with a strong track record.

6- Finzy

Providing unsecured loans for salaried individuals, Finzy boasts a quick and efficient loan application process with loan amounts ranging from Rs. 25,000 to Rs. 5 lakh and interest rates between 11% and 24% p.a.

They emphasize customer service and financial education.

7- Cash Kumar

Cash Kumar is a unique P2P lending platform in India that allows investors to participate in the working capital loans of the platform’s partner-backed businesses.

The platform offers a stringent borrower verification process, including credit scores, income proofs, and KYCs, ensuring guaranteed returns to investors.

Investors’ capital is spread across 200+ borrowers, reducing portfolio exposure per borrower to 0.5%.

Cash Kumar offers flexible investment options, with a minimum investment amount of just Rs. 10,000 and the potential to earn interest up to 10.5% annually.

As an RBI-licensed NBFC-P2P, Cash Kumar provides a low-risk investment opportunity with attractive returns.

8- Liquiloans

LiquiLoans (NDX P2P Private Limited) is India’s largest P2P NBFC, licensed and regulated by the Reserve Bank of India.

The platform offers an opportunity to earn up to 10.5% returns on investments, providing a lucrative alternative to traditional debt investments.

Founded by Achal Mittal and Gautam Adukia, the company utilizes technology to match borrowers and lenders, eliminating intermediaries and making borrowing more affordable.

LiquiLoans is funded by Matrix Partners, a prominent investor in companies like OlaCabs and Practo.

The platform’s transparent and secure approach, along with its high returns, has positioned it as a trusted and investor-friendly P2P lending platform in India.

How to Earn Passive Income with P2P Lending

After achieving certain level at our career, we all want to have a robust source of passive income for us and our family so that we can attain a much needed financial freedom.

So, just penning down certain strategies to earning passive income through P2P lending:

- Reinvestment: Reinvesting returns from repaid loans into new opportunities can compound earnings, potentially increasing overall returns over time.

- Diversification: Spreading investments across multiple loans can help mitigate risk and enhance the potential for consistent, passive income.

- Automated Portfolio Management: Some platforms offer automated reinvestment options, streamlining the process of putting repayments toward new loans, thus facilitating a more hands-off approach to portfolio management.

- Joining Forces with Other Investors: Collaborating with other investors can provide access to a broader range of opportunities and resources, potentially enhancing the potential for passive income.

By leveraging these strategies, an investors can potentially generate a steady stream of passive income through P2P lending, contributing to a diversified investment portfolio and financial stability.

Future Trends and Developments

If you read this article till here, it clearly means that you have a deep knack for P2P lending space.

So, we have to be rest assured that P2P lending is not just a trend.

It’s a revolution reshaping the financial landscape.

With increasing financial literacy and robust regulatory frameworks, the future of P2P in India looks bright.

It promises to democratize access to credit, fuel entrepreneurial ventures, and create a more inclusive financial ecosystem for all.

As per certain estimate, the P2P lending market in India is expected to growth to the size of $10.5 billion by 2026, means a CAGR of 21.6% from 2021.

Global P2P Successes and Failures

The P2P lending market in the world has grown significantly in the last several years.

In 2021 it was valued at USD 82,300 million. It is anticipated that this expansion will continue at a remarkable rate of 29.1% CAGR and touch USD 804,200 million by 2030.

With 80% of the P2P lending market, consumer lending is by far the largest category.

This expansion has been fueled by a variety of reasons such as growing use of digital platforms, the demand for alternative financing options, and the consistent rise in borrowers’ disposable income.

Interestingly, the P2P lending market is concentrated in North America and Europe, with the Asia-Pacific area seeing the quickest growth.

However, there are several important elements that contributed to the emergence and subsequent decline of P2P platforms in China.

Their transition from being only information intermediaries to providing principal guarantee conditions, taking on default risk from borrowers, and taking on significant credit risks formerly assumed by lenders were some of the main contributing factors.

This change effectively made a lot of platforms into shadow banks, which created unstable financial conditions.

Furthermore, China’s comparatively poor regulatory framework encouraged fraud and made it easier for dishonest people to take advantage of the system.

In one big controversy, those in charge of some P2P companies shamelessly embezzled investors’ money, resulting in huge losses.

It was a Ponzi scam. Furthermore, in order to put up asset pools, some platforms turned to fabricating information on borrowers.

Rather than using the money raised to further their original goals, they used it to finance their own operations.

Moreover, a significant fraction of unsuccessful platforms shut down for “usual” reasons including cash flow issues, a dearth of investors, or an inability to turn a profit. These elements worked together to make the P2P lending market in China unstable and unsustainable, which ultimately resulted in its demise.

P2P lending sites like Zopa, LendingClub, and Prosper, which operate in Western nations like the US and UK, were permitted to continue serving as information middlemen and never took on liability for borrower default, in contrast to the circumstances in China.

Rather, the onus of possible defaults continued to be on the lenders. In addition, a small number of trustworthy platforms that declined to provide principal guarantees controlled the majority of the P2P lending market in these nations.

P2P platforms in the US and UK operated in a more secure and well-regulated environment, producing more positive outcomes than the turbulent and risky environment that characterized China’s P2P lending industry.

These platforms had less competition, more sophisticated investors, and stricter regulation.

Conclusion

So, at the end, I would like to say that do your research thoroughly, choose a reliable platform, and explore the exciting world of P2P lending.

Whether you’re a borrower seeking flexible financing or a lender aiming for higher returns, this innovative ecosystem could be your gateway to financial freedom.

You can check this article at Medium and Substack .

FAQs

Is P2P lending legal in India?

Yes, P2P lending is legal in India. The Reserve Bank of India (RBI) has established a regulatory framework for P2P lending, and only corporate entities registered as ‘Companies’ can partake in P2P lending.

These companies must fulfill minimum capitalization requirements according to the RBI’s mandates, solidifying their financial stability.

The RBI plays an active role in vetting and approving prospective NBFC-P2P platforms, ensuring they meet regulatory criteria.

In essence, P2P lending in India operates within a carefully crafted regulatory framework, with the RBI at the helm, guiding the industry towards safety, transparency, and responsible lending practices.

Which is best P2P lending in India?

The best P2P lending platforms in India include India P2P, LiquiLoans, Faircent, LenDenClub, and Cash Kumar.

These platforms offer a range of investment options, with returns of up to 12% p.a. for lenders.

They are known for their stringent borrower verification processes, regulatory compliance, and transparent, secure approach, making them trusted and investor-friendly choices in the P2P lending landscape.

Additionally, these platforms cater to the evolving digital lending space, providing lucrative and legal investment prospects in India’s financial ecosystem.

What is the maximum limit for P2P lending India?

The maximum limit for P2P lending in India has been increased by the Reserve Bank of India (RBI) from INR 10 Lakhs to INR 50 Lakhs for an individual lender across all P2P lending platforms.

The aggregate exposure of a lender to all borrowers at any point of time, across all P2P platforms, is subject to a cap of INR 50 Lakhs.

However, if a lender lends above INR 10 Lakhs, a certificate from a practicing Chartered Accountant certifying a minimum net worth of INR 50 Lakhs is required.

Which P2P platform is RBI approved?

The best P2P lending platforms in India include India P2P, LiquiLoans, Faircent, LenDenClub, and Cash Kumar.

These platforms offer a range of investment options, with returns of up to 12% p.a. for lenders.

Can you lose money in P2P lending?

Yes, investing in P2P lending comes with risks, and there is a possibility of losing money.

The success of P2P lenders to limit loan losses varies by lender and over time. A lender can be talked into making a bad loan with a good sob story.

Borrowers with low credit ratings may default on loans, leading to a loss of investment. Additionally, P2P lending platforms are not insured, and there is a risk of the platform going bankrupt.

However, investors can mitigate these risks by conducting thorough research, diversifying their investments, and investing only an amount they can afford to lose.

Who bears risk in P2P lending?

In P2P lending, the risk is borne by both, the investors or lenders.

These risks include credit risk, platform risk, and regulatory risk.

Credit risk pertains to the potential for borrowers to default on their loans, leading to financial loss for the lenders.

Platform risk involves the possibility of the P2P lending site going bankrupt, resulting in the loss of funds for the investors.

Regulatory risk arises when the platform is unable to comply with the regulatory requirements, potentially impacting the investment.

Therefore, investors in P2P lending must carefully assess and manage these risks to make informed investment decisions.

Is Lendbox approved by RBI?

Yes, Lendbox is approved by the Reserve Bank of India (RBI) as an NBFC-P2P platform, ensuring compliance with the regulatory framework for P2P lending in India.

This approval solidifies Lendbox’s position as a trusted and regulated platform, offering a secure and transparent environment for both borrowers and lenders.

How much money do you need for P2P lending?

The amount of money required for P2P lending varies depending on the platform and the investment options available.

Some platforms offer flexible investment options, with a minimum investment amount of just Rs. 10,000.

However, it’s important to note that investors should only invest an amount that they can afford to lose. Additionally, investors should conduct thorough research before investing in P2P lending and diversify their investments across multiple loans and platforms to mitigate risk.

Which lending apps banned by RBI?

According to recent reports, the Reserve Bank of India (RBI) has banned several digital lending apps (DLAs) from accessing borrower’s mobiles, safeguarding borrowers from data privacy breaches, unfair business practices, and unethical recovery practices.

If feb’ 2023, Ministry of Electronics and Information Technology banned 94 loan apps. The list BNPL (Buy Now, Pay Later) such as Kissht & LazyPay.

What is the highest return on P2P?

In India, the P2P lending market is also known for offering competitive returns, with platforms providing yields of 10–14%4. Additionally, some investors in peer-to-peer loans have reported annual returns of greater than 10%.

LATEST POSTS

- Best Paper Trading Application In India

- Ashneer Grover Net Worth: Income, Wealth & LifeStyle!

- Stock Trading In India For Beginners: Step By Step Guide

- Vastu Shastra For Home: Boost Positive Energy Of Your Home.

- ESG Full Form || ESG Investing: A Complete Guide

2024 apartment Banking biography book review books Broking cards cibil score complete guide credit cards demat esg investment facts finance fintech flats forex governement schemes home home buying home loan investment loan mindset mind to matter mivan technologies mutual funds neobanks nri OC and CC p2p personal finance plots plots in lucknow reading habits real estate real estate terms retirement planning reviews stock market tax benefit taxes trading vastu