Introduction

Let’s dive into something exciting- Best Neo Banks In India!

These digital-first banks are shaking up the traditional banking scene with their tech-savvy, hassle-free solutions.

They’ve totally revamped the way we bank, offering seamless experiences at our fingertips.

Curious to know about the best ones in India? Ok. We will the best thing for the last.

But before that lets understand the following:

What are Neo Bank?

Imagine a neo bank like a really cool new kind of bank, but it’s not like the banks you see at Dalal street at Mumbai.

Instead, it lives inside your phone or computer!

Yep, no physical branches, just a super smart app that helps you do bank stuff, like saving money or checking how much you’ve got.

It’s like having a bank in your pocket, and it works a bit differently from the traditional banks such as HDFC, ICICI, Axis Bank, etc.

👉 READ MORE: ESG Investing- Full form of ESG || A Complete Guide

Why Neo Banks are gaining popularity?

From the last couple of years, Neo Banks are rapidly gaining popularity in India because of the following reasons:

Digital Convenience:

- Mobile-first approach: No physical branches to visit, meaning banking can be done anytime, anywhere with just a smartphone.

- User-friendly apps: Slick interfaces and intuitive navigation offer a smooth and enjoyable banking experience.

- Instant account opening: Gone are the days of queuing and paperwork. Sign-up processes are often quicker and paperless.

- 24/7 customer support: Online chatbots and readily available representatives provide convenient assistance.

Financial Advantages:

- Lower fees & charges: Many Neo Banks eliminate annual fees, minimum balance requirements, and hidden charges, making banking more affordable.

- Competitive interest rates: Some Neo Banks offer better deposit and savings account rates compared to traditional banks.

- Personalized financial tools: Budgeting apps, spending insights, and investment options help users manage their finances better.

- Innovative features: Instant loans, micro-investments, and integration with third-party financial services offer greater flexibility and convenience.

Shifting Demographics:

- Tech-savvy generation: Millennials and Gen Z are comfortable with digital platforms and prefer the ease and accessibility of Neo Banks.

- Growing demand for niche services: Some Neo Banks cater to specific needs like students, freelancers, or small businesses, attracting these underserved segments.

- Increased trust in digital alternatives: Consumers are becoming more familiar and comfortable with online financial services, including Neo Banks.

👉 READ MORE: Top 10 Most Expensive Shares In India

Five Types of Neo Banks

There are many ways to look into, however, Neo Banks in India can be categorized into five types based on their target audience and focus.

And they are as follows:

1- General Neo Banks

- Catering to a wide range of users: These Neo Banks offer basic banking services like savings accounts, current accounts, debit cards, payments, and money transfers. Examples include Jupiter, Niyo, Fi Money, and RazorpayX.

- Features: May offer additional features like budgeting tools, instant credit lines, bill payments, and investment options.

- Target audience: Young professionals, salaried individuals, students, freelancers, etc.

2- Niche Neo Banks

- Focus on specific user segments: These Neo Banks tailor their services and features to the needs of particular groups like students, freelancers, small businesses, or women. Examples include StashFin, FamPay, Open Money, and ZikZuk.

- Features: Offer features like educational loans, expense management tools, business accounts, micro-investments, and tailored savings plans.

- Target audience: Students, freelancers, small business owners, working women, etc.

3- Payment-Focused Neo Banks

- Specialize in payments and digital transactions: These Neo Banks emphasize quick and easy money transfers, bill payments, and online commerce transactions. Examples include Paytm Payments Bank and Airtel Payments Bank.

- Features: Offer features like QR code payments, UPI integration, mobile wallets, and bill recharge options.

- Target audience: Individuals who rely heavily on digital payments and online transactions.

4- Wealth Management Neo Banks

- Focus on investment and wealth management: These Neo Banks offer investment platforms, micro-investments, mutual funds, and wealth management tools. Examples include Groww and ETMONEY.

- Features: Offer portfolio tracking, automated investments, robo-advisors, and access to various investment products.

- Target audience: Individuals interested in growing their wealth through investments.

5- Corporate or Embedded Neo Banks

- Partner with existing businesses: These Neo Banks provide white-labeled banking solutions and infrastructure to companies to offer financial services under their own brand. Examples include Zeta and IDFC First Bank Neo.

- Features: Offer customized banking solutions for employees, customers, or specific industries.

- Target audience: Businesses looking to offer branded financial services or integrate financial features into their platforms.

Beside this, following points are also critical to understand:

- These categories are not mutually exclusive, and some Neo Banks might overlap with multiple categories.

- The Neo Bank landscape is constantly evolving, with new players and service offerings emerging regularly.

👉 READ MORE: Importance of Personal Finance Planning

Pro & Cons of a Neo Bank In India

Pros: Neo Banks In India

- Convenience: 24/7 access through mobile apps, no physical branches, instant account opening, and easy transactions.

- Lower fees: Many Neo Banks ditch annual fees, minimum balance requirements, and hidden charges, making them cost-effective.

- Innovation: Neo Banks embrace technology, offering features like instant loans, AI-powered budgeting tools, and seamless integration with third-party financial services.

- Personalization: Some Neo Banks tailor services to your needs, offering targeted investment options, budgeting templates, and spending insights.

- Security: Often use digital security measures like multi-factor authentication and data encryption to protect your finances.

- Transparency: Clear and upfront fee structures and terms of service.

Cons: Neo Banks In India

- Limited service range: Not all Neo Banks offer the full suite of services like traditional banks (loans, deposits, forex), so you might need additional accounts.

- Deposit insurance: While deposits are typically insured through partner banks, ensuring their reputation and reliability is crucial.

- Customer support limitations: Online chatbots or lack of physical branches might not suit everyone who prefers face-to-face interaction.

- Technical dependence: Requires a reliable internet connection and smartphone, and technical glitches could disrupt access.

- Newer players: Some Neo Banks are relatively new, and their long-term stability might be less established compared to traditional banks.

- Lack of physical security: No physical vaults or branches might raise concerns about physical theft or cyberattacks.

Besides this, consider the following points also:

- Target audience: Different Neo Banks cater to specific needs (students, businesses, etc.). Choose one that suits your requirements.

- Fees and charges: Compare costs across different Neo Banks and traditional banks to find the most affordable option.

- Customer reviews and reputation: Research the Neo Bank’s reliability and customer service experience before opening an account.

- Personal preferences: Decide how important factors like branch access, physical security, and customer support are for you.

In the end, the choice of whether to opt for a Neo Bank hinges on your specific needs and priorities.

Deliberating on the advantages and disadvantages thoughtfully, and taking into account your financial habits, will enable you to make a well-informed decision for efficiently handling your finances.

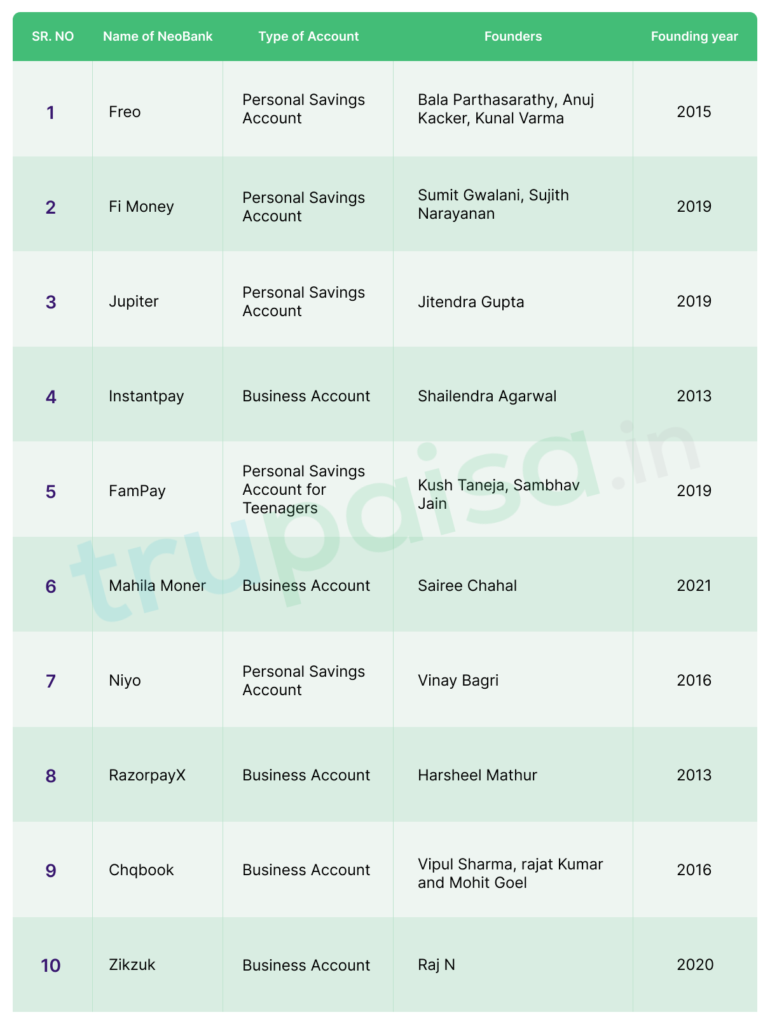

Best Neo Banks In India

Finally, here is the list of best Neo Banks in India:

FAQs

Is Neo Bank Safe?

Neo Banks in India: Secure, but with caveats. They offer advanced security tech and partner with established banks for insurance, making them generally safe. However, being newer players, they might have less history and rely heavily on online interactions. Choose wisely, practice online safety, and stay vigilant for scams.

Are Neo Banks legal in India?

While Neo Banks themselves aren’t directly licensed by the RBI in India, they operate legally by partnering with traditional banks for necessary infrastructure and regulatory compliance. These partnerships allow them to offer banking services like accounts, payments, and even loans. Essentially, you’re banking with the established bank, but through the Neo Bank’s convenient app-based interface. So, rest assured, your Neo Bank experience is legal and your deposits are typically insured through the partner bank. Just choose a reputable Neo Bank with a strong partner backing!

Is Neo Bank RBI approved?

Neo Banks themselves aren’t directly “approved” by the RBI in India.

They operate under a different regulatory framework compared to traditional banks. Here’s the gist:

- No independent banking licenses: Neo Banks can’t issue loans or hold deposits directly.

- Partnerships key: They partner with RBI-licensed banks for these core banking functions, leveraging their infrastructure and regulatory compliance.

- RBI oversight: While not directly licensed, Neo Banks still fall under the RBI’s purview through their partner banks and must comply with relevant regulations.

So, while Neo Banks themselves might not have an “RBI approved” stamp, their operations are indirectly regulated and overseen by the central bank through their partnerships with licensed institutions.

Remember, choosing a Neo Bank with a reputable and reliable partner bank is crucial for ensuring the safety and security of your finances.

How many Neo Banks are there in India?

The exact number of Neo Banks in India can fluctuate due to new players entering the market and potential consolidations. However, as of October 27, 2023, estimates suggest approximately 40 to 50 Neo Banks operating in the Indian market.

This includes established names like Jupiter, Niyo, Fi Money, RazorpayX, and Open Money, alongside newer entrants catering to specific niches like students, freelancers, and small businesses.

What are the key benefits of a Neo Bank?

Neo Banks ditch branches for apps, offering 24/7 banking on your phone. Expect lower fees, instant accounts, and innovative features like AI budgeting, micro-investments, and seamless third-party integration. All wrapped in a secure, tech-driven platform that fits your pocket, not your schedule.

Enjoy convenience, cost-effectiveness, and innovation at your fingertips, making Neo Banks a tempting alternative for tech-savvy, budget-conscious folks.

- Best Paper Trading Application In India

- Ashneer Grover Net Worth: Income, Wealth & LifeStyle!

- Stock Trading In India For Beginners: Step By Step Guide

- Vastu Shastra For Home: Boost Positive Energy Of Your Home.

- ESG Full Form || ESG Investing: A Complete Guide

2024 apartment Banking biography book review books Broking cards cibil score complete guide credit cards demat esg investment facts finance fintech flats forex governement schemes home home buying home loan investment loan mindset mind to matter mivan technologies mutual funds neobanks nri OC and CC p2p personal finance plots plots in lucknow reading habits real estate real estate terms retirement planning reviews stock market tax benefit taxes trading vastu