While Google Pay offers some financial features like P2P payments and bill payments, it’s not considered a true neobank. It lacks key features like checking accounts, debit cards, and investment options that core neobanks provide. So, while convenient for specific transactions, it doesn’t fully replace a traditional bank or neobank for comprehensive financial management.

Is Google Pay a Neo Bank? I know this question bothers us a lot.

So, lets remove curtain from this mystery today!

In the ever-changing realm of fintech, terms like “neobank” and “digital wallet” are frequently used.

However, as numerous players join the field, it can be challenging to discern the role of your trusty Google Pay app.

So, is Google Pay classified as a neobank?

Let’s demystify this question!

Defining a Neobank

Before delving into Google Pay, let’s grasp the concept of a neobank.

Neobanks are essentially financial institutions without traditional physical branches.

They operate primarily through mobile apps and online platforms, offering various financial services such as:

Current accounts

Similar to a conventional bank account, these allow you to manage money, receive salaries, and make payments

Debit cards

Most neobanks provide linked debit cards for convenient fund access.

Loans and savings products

Some neobanks extend limited loan options and savings accounts with competitive interest rates.

ALSO READ: Difference between a Neo Bank and a Payment Bank

The Appeal of Neobanks

What makes neobanks popular? Here are key reasons driving their growing user base:

Tech-Savvy Approach

Neobanks use technology to offer user-friendly apps, seamless integration with digital services, and intuitive financial tools.

Lower Fees

Often, neobanks can provide reduced fees compared to traditional banks due to lower operational costs.

Convenience

The 24/7 accessibility and on-the-go banking experience via mobile apps attract tech-savvy users

Targeted Solutions

Some neobanks tailor features and services to specific demographics or financial needs.

ALSO READ: Is Kotak 811 a Neo Bank in India? The Real Truth

Google Pay A Neo Bank- Expanding Horizons

Now, let’s focus on Google Pay. Initially a mobile payment solution, it has gradually broadened its services, offering:

Peer-to-peer payments

Instantly send and receive money from friends and family.

Bill payments

Easily settle utility bills, mobile recharges, and other recurring expenses.

Online merchant payments

Secure and convenient online shopping using Google Pay.

Reward programs

Earn cashback and rewards on specific transactions and purchases.

Investment options

In certain regions, access investment products like mutual funds via Google Pay.

ALSO READ: Best Neo Banks In India- A Personal Guide

So, is Google Pay a Neobank?

Here’s the crux.

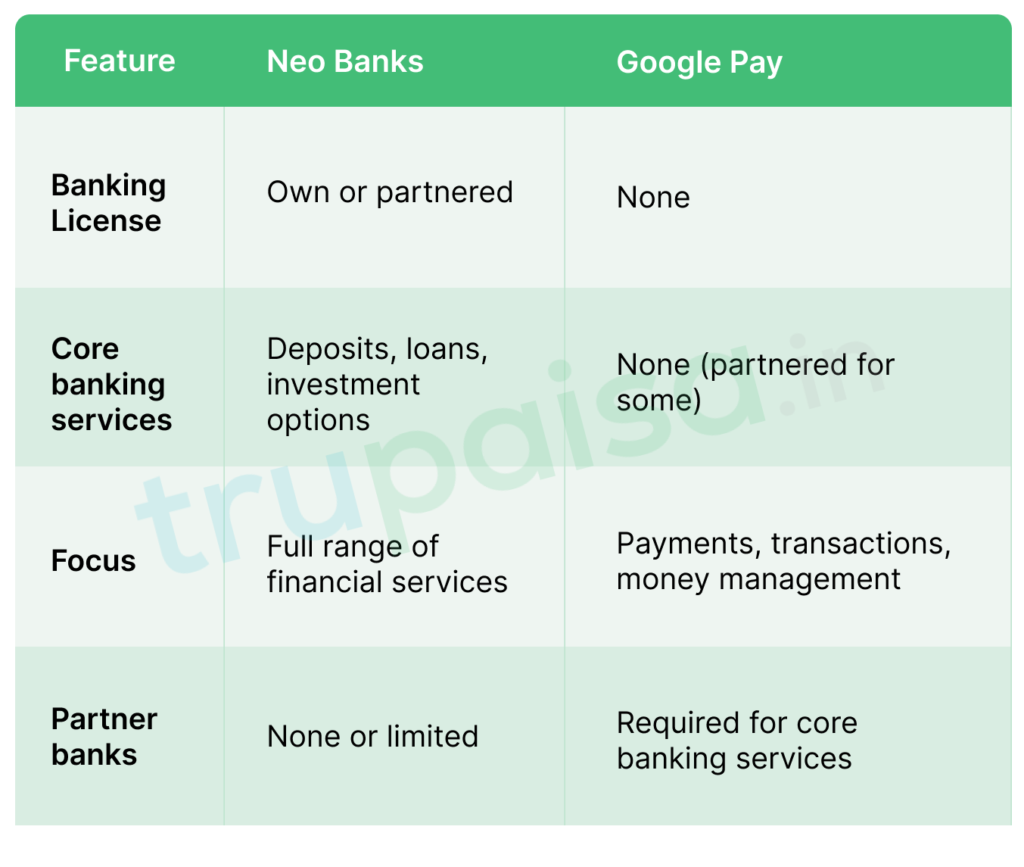

Although Google Pay shares some features with neobanks, it lacks core functionalities like current accounts, debit cards, or comprehensive loan products.

It primarily functions as a digital wallet and payment facilitator, collaborating with traditional banks to offer limited financial services

In strict terms, Google Pay doesn’t fit the neobank definition.

Nevertheless, it blurs the lines, incorporating functionalities typically associated with neobanks.

The Future of Google Pay

Google Pay’s evolution continues.

With a substantial user base, technological expertise, and strategic partnerships, it has the potential to expand its financial offerings, possibly introducing current accounts, debit cards, or limited credit products in the future.

Navigating the Digital Banking Landscape

As the digital banking landscape evolves, users must comprehend the services provided by different players.

Whether a traditional bank, neobank, or a hybrid like Google Pay, choose the one aligning with your financial needs.

In conclusion, while Google Pay currently falls short of being a complete neobank, it undoubtedly pushes the boundaries of digital wallet capabilities.

The future promises exciting possibilities, with Google Pay poised to redefine the digital banking experience for millions worldwide

Stay tuned – the competition in the digital banking arena is intensifying, and Google Pay is set to play a pivotal role in shaping its future!

LATEST POSTS:

- Best Paper Trading Application In India

- Ashneer Grover Net Worth: Income, Wealth & LifeStyle!

- Stock Trading In India For Beginners: Step By Step Guide

- Vastu Shastra For Home: Boost Positive Energy Of Your Home.

- ESG Full Form || ESG Investing: A Complete Guide

2024 apartment Banking biography book review books Broking cards cibil score complete guide credit cards demat esg investment facts finance fintech flats forex governement schemes home home buying home loan investment loan mindset mind to matter mivan technologies mutual funds neobanks nri OC and CC p2p personal finance plots plots in lucknow reading habits real estate real estate terms retirement planning reviews stock market tax benefit taxes trading vastu