Quick Summary: Moneytap is a legit app, but your own research. Moneytap is a registered NBFC offering instant personal loans and a credit line. While convenient and potentially fast, it’s crucial to compare rates and fees with other lenders and carefully review terms before applying. Remember, responsible borrowing involves thorough research and understanding the full cost of the loan. Explore alternatives and prioritize financial literacy for informed financial decisions.

Introduction

Are you tired of juggling multiple bills, struggling with unexpected expenses, or feeling limited by traditional loans?

Wondering if Moneytap is the answer to your financial woes?

Well, let me tell you, the search for financial freedom ends here.

In this comprehensive Moneytap review, I, as a seasoned personal finance expert, will dissect the platform inside out.

So, is Moneytap the real deal or just another financial gimmick?

Stick with me, and I promise you’ll uncover the truth and gain invaluable insights into revolutionizing your finances.

Also Read: HDFC Sky Review | Brokerage Charges, Free Demat A/c

What is Moneytap?

Moneytap is a one-stop platform offering a credit line and personal loans.

You can think of it like a virtual credit card, allowing you to borrow money as needed, up to a pre-approved limit. This flexibility is a key feature of Moneytap.

Also Read: FYERS Review | Brokerage Charges, Margin, Trading

How Does Moneytap Work?

Understanding the functionality of Moneytap is crucial. Here’s a breakdown:

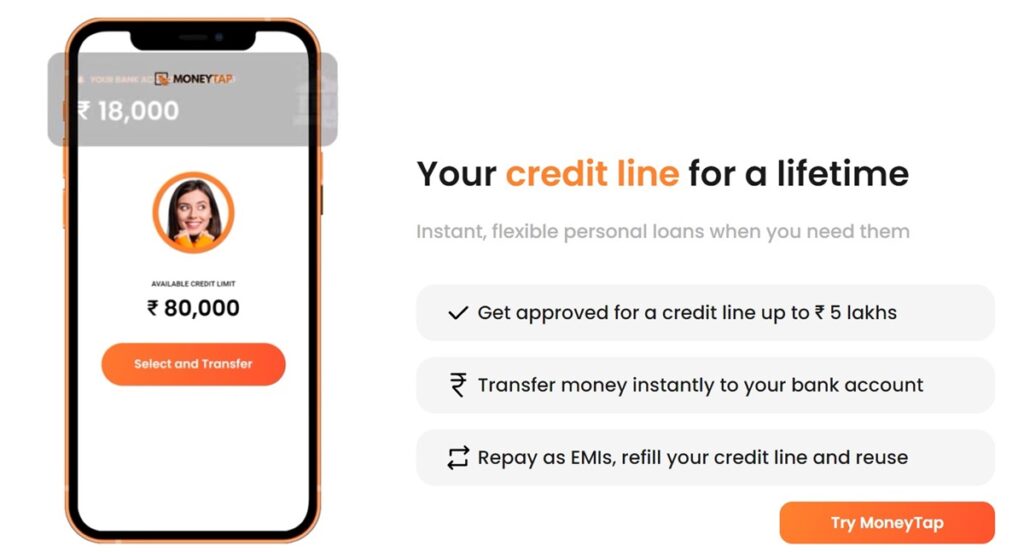

- Credit Line: You get a pre-approved credit limit, similar to a credit card. You can then use this limit to make purchases online or transfer funds to your bank account.

- Interest Rates: Interest is charged only on the amount you utilize, not the entire credit limit.

- Repayment: You can choose flexible repayment options to fit your budget.

Also Read: Robert Kiyosaki Life Story | Secret Revealed!

Key Features of Moneytap

- Chat-Based Application Process: Interactive chatbot guides you through the registration process, ensuring a user-friendly experience.

- Fast Approvals: Receive your pre-approved limit within minutes, followed by a full approval in a few days.

- Competitive Interest Rates: Enjoy rates that are typically 1.5% lower than standard bank rates for personal loans.

- Easy Repayment Management: Manage payments according to your budget, with the flexibility to pay interest only on the amount you borrow.

Pros and Cons of Moneytap

Pros

- Convenience: Easy online application, quick approvals, and flexible repayment options.

- Flexibility: Borrow only what you need and only pay interest on the utilized amount.

- Paperless Experience: Entire process from application to repayment is online and paperless.

- Faster than Traditional Loans: The application process is quicker and simpler than traditional loans.

Cons

- Interest Rates: Interest rates can be higher compared to traditional loans.

- Temptation to Overspend: Easy access to credit can lead to overspending and debt.

- Not for Everyone: Requires financial discipline and responsible borrowing habits.

- Compare Rates: Always compare Moneytap’s interest rates with other loan options before applying.

Also Read: Cred Review || Is Cred App Safe to Use

Moneytap vs. Traditional Loans: A Comparison

| Feature | Moneytap | Traditional Loans |

|---|---|---|

| Application Process | Quick and convenient, often online | Lengthy paperwork, in-person visits |

| Approval Time | Rapid approval, sometimes within minutes | Slower processing, can take days or weeks |

| Flexibility | Flexible repayment options | Fixed repayment schedules |

| Interest Rates | Competitive rates | Rates may vary, often higher for some borrowers |

| Loan Amounts | Variable, based on creditworthiness | Fixed amounts, limited flexibility |

| Collateral Requirement | May or may not require collateral | Often requires collateral, such as property |

| Accessibility | Available 24/7, accessible via app | Limited access, often during business hours |

| Credit Score Impact | May have minimal impact on credit score | Can impact credit score, especially if missed payments |

| Customer Experience | User-friendly interface, responsive customer service | Varies widely depending on lender |

Also Read: InCred Money Review | Alternate Investment Platform

Tips for Maximizing Moneytap Benefits

- Utilize the app’s built-in calculator to determine the ideal loan amount based on your income and spending habits.

- Keep track of your outstanding balance and repayment schedule to avoid late fees and maintain good credit health.

- Consider setting up automatic repayments from your salary account to ensure consistent and timely payments.

Also Read: Namita Thapar || An Inspiring Story

Also Read: LenDenClub Review || P2P Lending Platform In India

Real User Experiences with Moneytap

Moneytap has garnered a mix of reviews from users, reflecting both positive and negative experiences.

Here is a glimpse into what users have shared about their interactions with Moneytap.

- Users have praised Moneytap for its swift and hassle-free approval process, with many highlighting the convenience of receiving a pre-approved limit within minutes of registration.

- On the flip side, some users have expressed dissatisfaction with their Moneytap experience, citing issues such as unexpected fees, unclear terms, and difficulties in accessing customer support.

While individual experiences may vary, Moneytap remains a viable option for those seeking quick access to credit lines with competitive rates.

Founders: Moneytap

Personal Loan EMI Calculator: Moneytap

If you want to calculate EMI on your loan from Moneytap, either click on below image or, click here.

Conclusion

As discussed above, Moneytap is a legitimate & convenient option for individuals seeking quick and easy access to credit.

However, I would strongly recommend a responsible borrowing and careful consideration of your financial situation before using any credit product.

By understanding Moneytap’s features, comparing it with other options, and taking user reviews into account, you can make an informed decision about whether Moneytap aligns with your financial needs and goals.

As a personal finance expert, I encourage you to prioritize responsible borrowing and financial literacy.

Remember, knowledge truly is power, especially when navigating the complex world of personal finance.

FAQs

Is MoneyTap app safe?

MoneyTap is a genuine and secure app that offers a personal line of credit up to 5 lakhs through a secured paperless process on your phone.

It operates in partnership with banks, adheres to RBI guidelines, requires proper document proofs, has received industry recognition, and is backed by investors like Sequoia Capital.

The app ensures security through robust protocols, passcode protection, and encrypted data transfer.

MoneyTap’s features include instant approval, a MasterCard credit card with flexible cash withdrawal options, and secure transactions with OTP authentication.

Overall, MoneyTap is a reliable platform for accessing credit efficiently and securely.

How much interest does MoneyTap charge?

MoneyTap charges an annual interest rate ranging from 13% to 42% on the amount of money withdrawn.

The exact interest rate depends on factors like credit profile, past defaults, and the repayment tenure chosen, which can vary from 2 months to 3 years.

Additionally, MoneyTap levies a processing fee of up to 7% plus service tax each time cash is withdrawn.

The app provides transparency by displaying all fees and interest rates clearly to users, ensuring they are aware of the costs involved in using the service.

Is MoneyTap approved by RBI?

Yes, MoneyTap is approved by the Reserve Bank of India (RBI) as it has obtained an NBFC license from the RBI.

MoneyTap operates under the strict norms and guidelines set by the RBI, ensuring compliance with RBI rules and regulations.

The final credit line provided by MoneyTap comes through partner banks, and the approval process is governed by their underwriting rules.

Additionally, MoneyTap has been recognized in the industry and has received funding from investors like Sequoia Capital, NEA, and Prime Venture Partners, further establishing its credibility.

Who owns MoneyTap?

MoneyTap was founded by Anuj Kacker, Bala Parthasarathy, and Kunal Varma, who are alumni of IIT and ISB.

Bala Parthasarathy serves as the Chairman and Co-founder of MoneyTap.

The company has received significant funding, including a $70 million round in January 2020, with prime investors like Sequoia Capital India and Prime Venture Partners.

MoneyTap was awarded a Non-Banking Finance Company license by the RBI in 2019, enhancing its market position.

Additionally, Renaud Laplanche, a prominent figure in Fintech, joined MoneyTap’s advisory board, signaling the company’s readiness for global expansion.

Can I foreclose MoneyTap loan?

To foreclose a MoneyTap loan, the process varies depending on the finance partner.

For RBL Bank-approved customers, you can foreclose the loan at any time without charges.

However, for other finance partners, you can only foreclose after paying at least 3 EMIs, with a charge of 3% to 5% of the outstanding loan amount.

Foreclosing a personal loan can reduce your total loan burden and positively impact your credit score in the long run.

My Social Links: Quora, Facebook, Linkedin, Pinterest, X (Twitter)