Introduction

In today’s world, investing has become an essential part of financial planning.

With the rise of digital platforms, investing has become more accessible and convenient than ever before.

InCred Money is one such platform that offers an alternate investment option to traditional savings accounts.

In this comprehensive review, we’ll explore the features, benefits, and drawbacks of InCred Money, and help you decide if it’s the right investment platform for you.

What is InCred Money?

InCred Money, backed by the established InCred group, positions itself as a gateway to high-potential, non-traditional investments.

Its offerings transcend the usual suspects, venturing into market-linked debentures, structured products, and thematic investment opportunities.

Think real estate, infrastructure projects, and thematic portfolios focused on specific sectors like healthcare or technology.

Incred Money Team

InCred Money was founded by Bhupinder Singh, who envisioned democratizing alternate asset classes for retail investors.

Alongside Bhupinder Singh, the following professionals contribute to the success of InCred Money:

- Abhishek Verma – Senior Staff Software Engineer

- Varun Shah – Content & Strategy Lead

- Ashish Oswal – Investments Sales Lead

- Priyansh Saxena – Head of Customer Experience

- Yash Shah – Product Manager

- Preetam Patnaik – Saumya Mittal

- Akshat Shrivastava

This multidisciplinary team combines expertise in software engineering, content strategy, sales, customer experience, product management, and more, ensuring that InCred Money delivers innovative solutions to meet the growing demands of modern investors.

InCred Money Review: Features

Investment Options

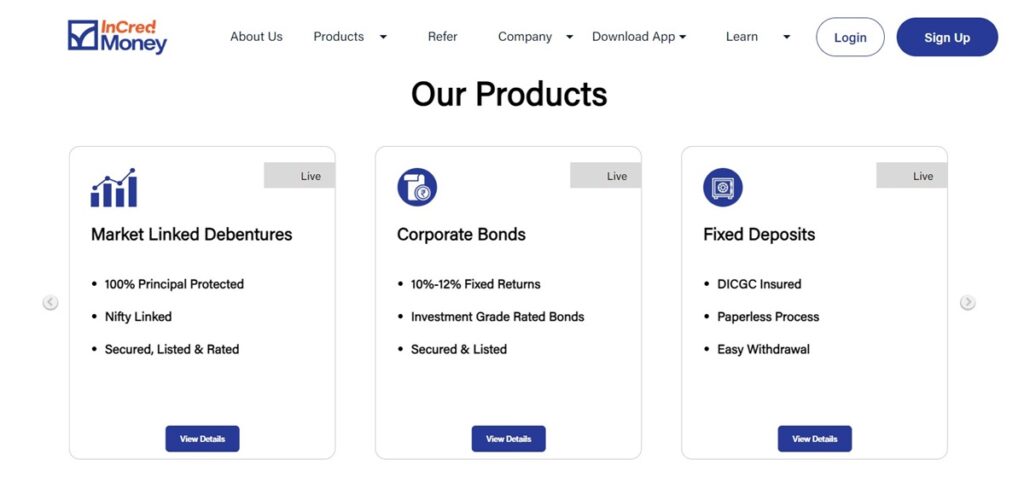

The variety is undoubtedly InCred Money’s biggest draw. You’ll find options like:

- Market-Linked Debentures (MLDs): These offer principal protection with potential returns linked to market indices like Nifty 50.

- Structured Products: These combine multiple asset classes (stocks, bonds, etc.) to tailor risk-return profiles.

- Thematic Portfolios: Focus on specific sectors, potentially offering higher returns if the chosen sector thrives.

Remember: These options generally involve higher risks compared to traditional investments.

Minimum Investment

InCred Money caters to a broader audience with minimum investments starting at Rs. 10,000, making it accessible even for budding investors.

User Interface and Experience

The platform boasts a clean and user-friendly interface, accessible through web and mobile app. Information is readily available, with investment details clearly presented.

Customer Support

While they offer support options via email and phone, live chat functionality would enhance the real-time support experience.

Also Read: HDFC Sky Review | Brokerage Charges, Free Demat A/c

InCred Money Review: Pros and Cons

Pros:

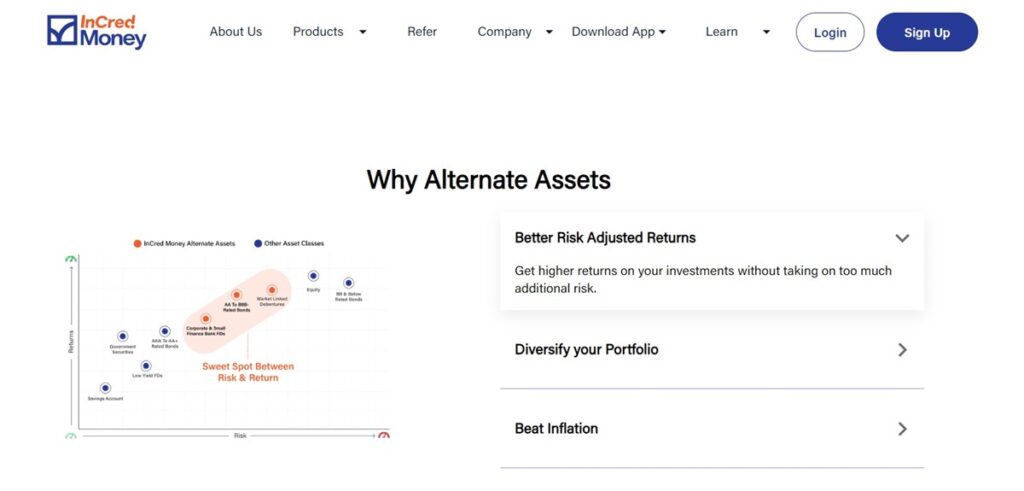

- Unique Investment Options: Access an exciting array of alternative investments not readily available elsewhere.

- Low Minimum Investment: Opens doors for new investors with smaller portfolios.

- Transparent Platform: Offers clear information on each investment product.

- Potential for Higher Returns: Some options like thematic portfolios can offer higher returns compared to traditional avenues.

Cons:

- Higher Risks: Alternative investments, by nature, carry greater risk compared to stocks and mutual funds.

- Limited Track Record: InCred Money is relatively new, and its long-term performance remains to be seen.

- Limited Customer Support Options: Lack of live chat might restrict accessibility for some users.

Also Read: FYERS Review | Brokerage Charges, Margin, Trading

Also Read: Cred Review || Is Cred App Safe to Use

InCred Money Review: Should You Invest?

Ultimately, the decision depends on your individual risk tolerance and investment goals.

If you’re comfortable with exploring beyond traditional avenues and understand the inherent risks, InCred Money can be an intriguing platform.

However, thorough research and a cautious approach are crucial before investing.

Here are some tips for using InCred Money wisely:

- Start small: Begin with a minimal investment to test the waters before committing larger sums.

- Do your research: Understand each investment option thoroughly, including its risks and potential returns.

- Diversify: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes.

- Consult a financial advisor: Seek professional guidance to ensure these investments align with your overall financial plan.

Also Read: LenDenClub Review || P2P Lending Platform In India

Also Read: 12% Club Review- Features, Advantage & Disadvantages

Incred Money Review: Alternatives

While InCred Money offers unique alternative investment options, it’s not the only player in the game.

Depending on your specific needs and risk tolerance, several alternatives might be worth exploring:

Platforms for Diverse Alternative Investments

- Groww: Offers curated alternative investment options like corporate bonds, structured products, and real estate investment trusts (REITs). Minimum investment varies by product.

- Cube Wealth: Provides access to curated private debt opportunities and structured products, aiming for high potential returns. Minimum investment starts at Rs. 25,000.

- Alternative Investment Market (AIM) by NSE: A platform connecting investors with issuers of alternative investments like infrastructure bonds and debt securities. Requires a high net-worth status and minimum investment amounts can be significant.

P2P Lending Platforms

- Lendingkart: Facilitates peer-to-peer (P2P) lending to small and medium-sized enterprises (SMEs) with potentially high returns but inherent risks.

- Faircent: Another P2P platform offering diverse loan options with varied risk-return profiles. Requires thorough due diligence before investing.

- CashRich: Connects investors with borrowers for short-term loans, targeting high returns with high associated risks.

Angel Investing Platforms

- LetsVenture: Connects accredited investors with early-stage startups for potentially high returns but significant risks and long investment horizons.

- AngelList India: Another platform for angel investing in startups, requiring accreditation and substantial minimum investment amounts.

Traditional Alternatives

- Real Estate Investment Trusts (REITs): Invest in income-generating real estate through publicly traded REITs for diversification and potential rental income.

- Corporate Bonds: Bonds issued by companies can offer fixed income with varying risk profiles depending on the issuer’s creditworthiness.

- Gold Funds: Invest in gold electronically through mutual funds for diversification and potential portfolio hedging.

Remember: Each alternative platform and investment option carries its own unique risks and complexities.

Thorough research, understanding your risk tolerance, and seeking professional guidance are crucial before making any investment decisions.

Conclusion: My Experience | Verdict

InCred Money presents a compelling option for investors seeking diversification and access to alternative investments.

However, its relative infancy, higher risks, and limited support options require careful consideration.

Remember, diversify, research, and prioritize your risk tolerance before venturing into this exciting, yet potentially turbulent, investment realm.

Disclaimer: This information is for general knowledge only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions

FAQs

Is InCred Finance real or fake?

InCred Finance is a real financial services company that offers a range of financial products and services, including personal loans, student loans, school financing, and more.

InCred Money, a subsidiary of InCred Finance, is a digital platform that offers an alternate investment option to traditional savings accounts.

InCred Finance is a regulated entity under the Reserve Bank of India (RBI) and has established a strong reputation across multiple businesses in the Indian financial services market.

The company has a team of experienced professionals with expertise in various fields, including finance, software engineering, content strategy, sales, customer experience, and product management.

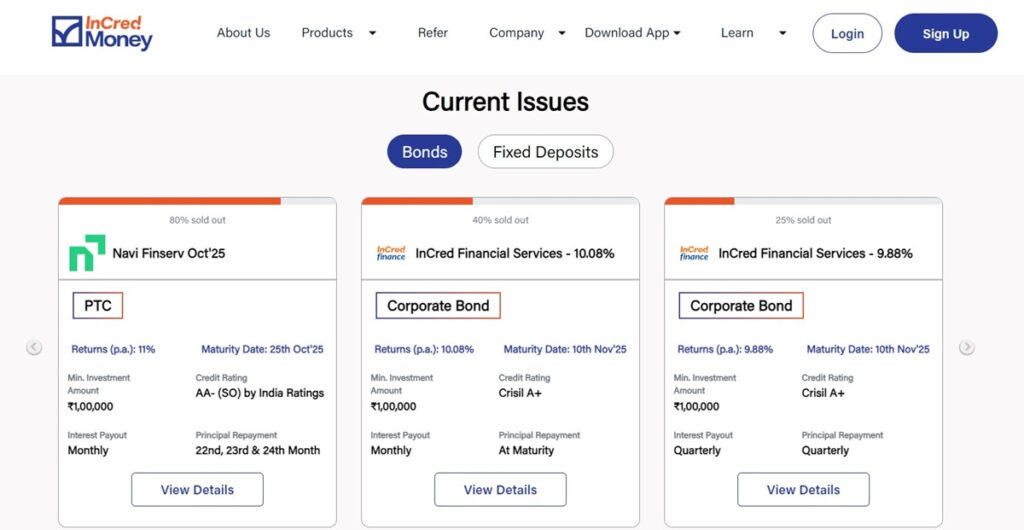

Is InCred bonds safe?

InCred Financial Services Limited’s bonds are considered secure due to their collateral backing, which enhances their safety.

Many of these bonds carry an A+ rating, indicating a high degree of trustworthiness and stability.

However, like all investments, InCred bonds carry certain risks, particularly related to changes in market conditions and the possibility of defaults.

Therefore, it’s crucial to conduct thorough research and analyze the issuer’s credit history before deciding whether to invest in InCred bonds.

Remember that past performance is not indicative of future results, and all investments involve inherent risks.

Is InCred registered with RBI?

Yes, InCred Money is registered with the Reserve Bank of India (RBI) as a non-banking finance company (NBFC).

The platform is also regulated by the Securities and Exchange Board of India (SEBI), ensuring that it adheres to the highest standards of transparency and accountability.

What is the interest rate of InCred money?

InCred Money offers a range of investment products, but specific interest rates are not detailed for their alternate investment platform.

However, InCred Financial Services, a sister entity, provides personal loans with interest rates starting at 13.99%, varying according to the borrower’s credit score, loan amount, and repayment tenure.

In contrast, InCred Money focuses on alternate investment opportunities rather than loans, offering returns up to 9.10% annually.

Keep in mind that the interest rates mentioned here pertain to separate products and may not directly reflect the return rates on InCred Money’s investment offerings.

How safe is InCred money?

nCred Money is a secure and reliable alternative investment platform, backed by the InCred group, a well-respected financial services conglomerate in India.

Key factors contributing to the safety of InCred Money include:

- Registration as a Non-Banking Finance Company (NBFC) with the Reserve Bank of India (RBI).

- Strong net worth requirements set forth by regulatory bodies.

- Access to extensive resources and expertise within the InCred group.

- Management led by seasoned professionals with experience in the finance sector.

- Compliance with relevant laws and regulations governing the financial services industry.

However, it’s crucial to note that investing carries inherent risks, and past performance is not indicative of future results. Therefore, it’s essential to conduct thorough due diligence and seek professional guidance before making any investment decisions.

What is the minimum cibil score for InCred?

The minimum CIBIL score for InCred personal loans is 625.

This score is lower than the typical requirement of 750 or more from banks and other institutions, making InCred more accessible to a broader range of borrowers.

What is the legal name of InCred?

The legal name of InCred is InCred Financial Services Limited, which is a Non-Banking Financial Corporation registered with the Reserve Bank of India (RBI).

InCred Financial Services Limited is a part of the InCred group, a leading financial services company in India, offering a range of financial products and services, including personal loans, student loans, school financing, anchor loans, and more.

Who is the CEO of InCred?

The CEO of InCred is Bhupinder Singh, who is also the founder of the company.

Prior to InCred, he was the head of the Corporate Finance division of Deutsche Bank and co-headed the Fixed Income, Equities, and Investment Banking divisions for the Asia Pacific region.

Is InCred a NBFC?

InCred Financial Services Limited is classified as a Non-Banking Financial Corporation (NBFC).

Established as a tech-driven and analytics-oriented organization, InCred offers a variety of loan products, including personal loans, education loans, school financing, and merchant loans.

Their mission is to serve the unique needs of Indian households while maintaining high standards of transparency, integrity, and continuous improvement.

What is the processing fee of InCred ?

InCred charges a loan process and administration fee, which is generally set at around 1% – 1.5% of the loan amount.

This fee is not an upfront fee and is payable only upon provisional loan approval.

The fee typically represents the cost of originating the loan as well as various expenses associated with verifications, documentation, legal opinions, etc. related to the loan evaluation process.

What is the age limit for InCred?

The age limit for InCred varies depending on the financial product.

For InCred personal loans, the applicant’s age should be between 21 and 55 years old.

However, for InCred student loans, the age limit is not specified, and eligibility is determined based on factors such as the student’s academic and career records, co-signer’s creditworthiness, and more.

InCred is a registered non-banking finance company with the Reserve Bank of India.

For InCred Money, the alternate investment platform, minimum KYC documents such as PAN, address proof, bank account details, and Demat details are required for onboarding.

What companies are similar to InCred?

InCred’s competitors include Avanse, Auxilo, HDFC Credila, Lendingkart, MyShubhLife, axio, LoanTap, KarmaLife, Ftcash, Indifi, Aye, and MyMoneyMantra.

These companies offer a range of financial services, including loans, credit analysis, and investment options, catering to the diverse needs of investors and borrowers.

What is InCred Bank?

No. InCred Bank is a new-age financial services platform that leverages technology and data-science to make lending quick and easy.

It offers a range of financial products, including personal loans, education loans, SME business loans, and merchant loans.

InCred Bank is a part of the InCred group, a leading financial services company in India, and is regulated by the Reserve Bank of India (RBI).

The company aims to create a trustworthy, transparent, and highest integrity financial institution that positively advances the socio-economic well-being of lower-middle-class to middle-class Indian households while protecting the interests of all stakeholders.

How do I contact InCred?

Reach out to InCred through multiple channels:

- Email: support@incredfinance.com

- Phone: +91 99100 99000 (Monday – Friday, 9 AM – 6 PM)

- Social Media: Facebook (@IncredFinanceIndia), Twitter (@Incred_Finance)

- Website Contact Form: www.incredmoney.in/contact-us

For specific queries related to InCred Money, use the email address money@incredfinance.com or reach out through the dedicated phone number mentioned above.

How do I repay my InCred education loan?

InCred offers automatic EMI repayments deducted directly from your bank account each month.

You can also manually pay through net banking, UPI, or their website/app. Remember to quote your loan ID and pay before due dates to avoid penalties.

What is the moratorium period for InCred?

InCred, primarily known for its educational loans, does not explicitly provide a moratorium period for its alternate investment platform, InCred Money.

However, InCred Financial Services Limited offers flexible repayment tenures for collateral-free loans, which suggests that they might consider customized repayment structures depending on the nature of the loan or investment product.

Therefore, interested parties should directly contact InCred Money regarding specific repayment terms and conditions.

My Social Links: Quora, Facebook, Linkedin, Pinterest, X (Twitter)