Introduction

I know you are here for “Cred Review”. So, let me welcome you to my comprehensive review of Cred, a platform that has been making waves in the personal finance world.

In this blog post, I will provide you with an in-depth analysis of Cred, covering its features, benefits, and how it can potentially revolutionize the way you manage your finances.

As a personal finance expert, I understand the importance of leveraging the right tools to achieve your financial goals, and Cred is one such tool that has garnered significant attention.

Join me as we explore the various facets of Cred and how it can empower you to take control of your financial well-being.

What is Cred App?

Cred is a multifaceted personal finance platform that offers a wide array of services designed to streamline and optimize your financial management.

From credit score monitoring to bill payment reminders, Cred aims to be a one-stop solution for individuals looking to enhance their financial literacy and take charge of their economic future.

The platform’s user-friendly interface and comprehensive features make it an attractive option for those seeking to simplify their financial lives.

ALSO READ: 12% Club Review- Features, Advantage & Disadvantages

ALSO READ: Choice Broking Review: Flat-Fee Hero or Myth Maker?

How Does the Cred App Work?

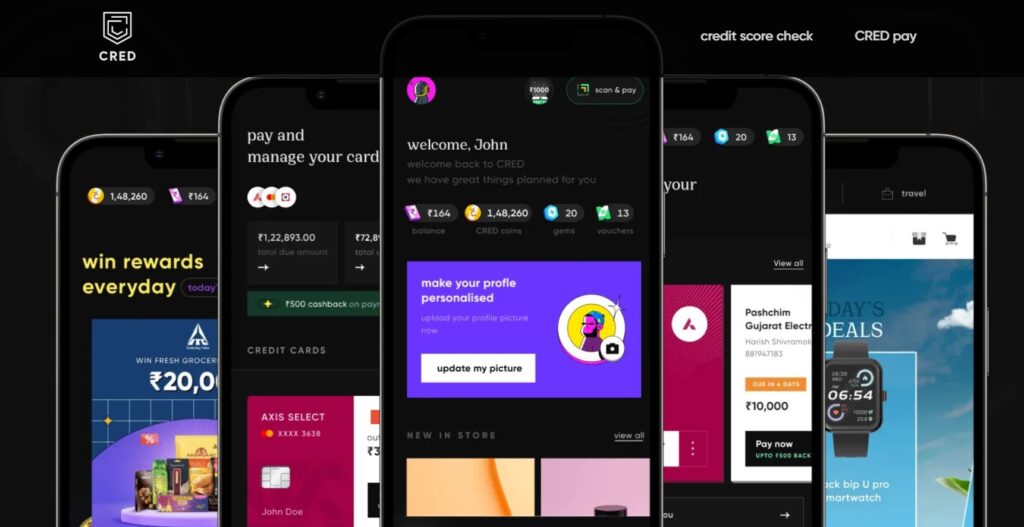

The Cred app offers a high-tech and premium everyday card spending experience, providing a 100% mobile platform with a free metal card.

It guarantees no fees or interest, enables automatic credit building, and allows early paycheck access.

The app’s features include real-time control, virtual Stealth Cards™, and 24/7 support.

However, it has received mixed reviews, with some users praising its functionality and earning potential, while others have criticized it for payment delays, poor customer support, and unfriendly user interfaces.

Therefore, caution is advised when using the app, especially for purchases, returns, and customer service.

Cred Review: Major Benefits

Effortless Bill Payment

Pay your bills from various banks in a single click. No more juggling multiple apps or websites. Plus, Cred sends timely reminders so you never miss a payment.

Exclusive Rewards

Cred partners with renowned brands to offer lucrative rewards on bill payments. These include cashback, travel miles, vouchers, and discounts on popular e-commerce platforms.

Credit Score Tracking

Monitor your credit score within the app, allowing you to track your financial health and make informed decisions.

Exclusive Membership Perks

Cred offers tiered membership benefits based on your credit score and payment history. These perks include higher reward points, access to curated experiences, and concierge services.

ALSO READ: Can I start forex trading with 1000 rupees

ALSO READ: How To Convert Visa Card To Rupay Card

Cred Review: Potential Drawbacks

Limited Payment Options

Currently, Cred only accepts credit card bill payments. Other forms of bills, like utilities or rent, are not yet supported.

Eligibility Requirements

Not everyone can join Cred. You need a good credit score (750+) and an Indian credit card to be eligible.

Reward Dependency

Reward points are dependent on partner offers, which can change frequently. Some users might not find value in every offered reward.

Limited Customer Support

Customer support options might seem limited compared to traditional banking channels.

Cred Review: My Verdict

To sum up, Cred is an impressive personal finance platform that provides a plethora of tools and advantages to anyone looking to improve their financial management and literacy.

With the help of its credit score tracking, bill payment alerts, and tailored recommendations, you may develop more responsible financial practices and work toward reaching your long-term financial goals.

As a specialist in personal finance, I strongly advise investigating Cred’s possibilities and adding it to your toolkit.

Cred possesses strong capabilities and an easy-to-use interface that make it a great ally on your path to financial emancipation.

ALSO READ: Best Neo Banks In India- A Personal Guide

ALSO READ: Is Kotak 811 a Neo Bank in India? The Real Truth

FAQs

What is Cred Flash?

CRED Flash is a “Buy Now Pay Later” (BNPL) service offered by the fintech unicorn CRED.

This service allows customers to make payments on the CRED app and across various merchant partners, with the flexibility to clear the bill within 30 days at no extra charge.

CRED Flash is the second lending service available on the app, alongside CRED Cash, a personal loan offering.

Users can also use CRED Flash to make bill payments and recharges. The tap-to-pay feature, known as Tap & Pay, enables users to make payments using credit cards on their phones with a simple tap on the terminal machine.

It is designed to provide a fast, simple, and secure offline payment experience for CRED members. While CRED Flash offers convenience in payments, it is important to be cautious as it can impact your CIBIL score since it counts as a loan.

Is Cred App Safe to Use?

The safety of the Cred app is a matter of mixed reviews and experiences.

While some users appreciate its functionality and services, others have criticized it for payment delays, poor customer support, and unfriendly user interfaces.

Caution is advised when using the app, especially for purchases, returns, and customer service.

Who Can Use the Cred App?

Anyone can use the Cred app, which offers a range of features designed to streamline and optimize personal finance management.

The app’s user-friendly interface and comprehensive features make it an attractive option for individuals looking to simplify their financial lives.

However, it is important to note that the app has received mixed reviews, with some users praising its functionality and earning potential, while others have criticized it for payment delays, poor customer support, and unfriendly user interfaces.

Therefore, it is essential to exercise caution when using the app, especially for purchases, returns, and customer service.

Is it worth paying through CRED?

The Cred app has received mixed reviews, with some users praising its functionality for credit card payments and bill reminders, while others have criticized it for payment delays, poor customer support, and unfriendly user interfaces.

Therefore, caution is advised when using the app, especially for purchases, returns, and customer service. It’s essential to weigh the app’s benefits against the reported issues to determine if it’s worth using for your specific needs and circumstances.

Does CRED affect credit score?

Cred’s credit score monitoring tool can help you track your progress and identify areas for improvement, but it does not directly impact your credit score.

However, by using Cred’s bill payment reminders and other features to manage your finances responsibly, you can potentially improve your credit score over time.

It’s important to note that payment history and credit utilization are the two most important factors that affect your credit score, so using Cred to stay on top of your bills and manage your debt can be a valuable tool in your financial toolkit.

What are the disadvantages of using CRED?

Some of the disadvantages of using CRED include a rewards catalog filled with offers that are least used by customers, and the requirement for access to your email account to view your email messages for analyzing your credit card statements, which may raise security concerns.

Additionally, the app saves all credit card details when you register on the platform, and it only allows consumers with credit scores higher than 750 to join the CRED community and make payments.

Furthermore, users have reported issues with failed payments and the inability to tag payments made outside of the platform.

Can we transfer money from credit card to GPAY?

Yes, it is possible to transfer money from a credit card to Google Pay.

To do this, you can add your credit card to your Google Pay account and use it for various transactions, such as bill payments, online purchases, and more.

However, it’s important to note that the ability to use a credit card for Google Pay transfers may be limited, and there could be fees associated with such transactions.

Additionally, the availability of this feature may vary based on the region and the specific credit card issuer.

Therefore, it’s advisable to review the terms and conditions related to credit card usage on Google Pay and to consider any potential fees or restrictions before initiating a transfer.

Does CRED work without credit card?

Yes, CRED works without a credit card. The app allows users to pay credit card bills through net banking, Unified Payments Interface (UPI), and the auto-pay feature on the app.

It also offers various other features such as credit score monitoring and bill payment reminders, making it a comprehensive tool for financial management.

Is CRED a Chinese app?

No, CRED is not a Chinese app. It is an Indian app that offers a platform to save and pay credit card bills, and provides various other financial services.

It is designed to cater to the Indian market and is not of Chinese origin.

How do I pay money from CRED?

To pay money from the Cred app, you can follow these steps:

- Log in to your Cred account through the app.

- The bill amount as well as the minimum due will be displayed.

- You can pay credit card bills through net banking, Unified Payments Interface (UPI), and the auto-pay feature on the app.

Additionally, Cred allows you to pay your credit card bills and earn rewards. When you pay your credit card bills on Cred, you receive Cred coins, which can be used to win exclusive rewards and cashbacks.

Is CRED free or chargeable?

CRED is a free app that allows users to pay their credit card bills and earn rewards.

It offers various features such as credit score checks, bill payment reminders, and exclusive rewards for paying bills. The app is designed to provide a seamless and rewarding experience for managing credit card payments.

Can you withdraw cash from CRED?

CRED is a free app that allows users to pay their credit card bills and earn rewards.

It offers various features such as credit score checks, bill payment reminders, and exclusive rewards for paying bills.

The app is designed to provide a seamless and rewarding experience for managing credit card payments.

Who is owner of CRED?

Kunal Shah is the founder and CEO of Cred, a fintech startup that rewards credit card users for paying their bills on time.

He is an Indian entrepreneur who previously founded FreeCharge, a cashback and promotional discount campaign platform for retailers that was acquired by Snapdeal in 2015.

Before that, he launched PaisaBack, a similar platform that eventually turned into FreeCharge. Kunal Shah is a university dropout who enrolled himself in a management course at NMIMS in 2003 but decided to drop out and pursue his entrepreneurial dreams.

He founded Cred in Bangalore in 2018, and the company has since grown to become one of India’s fastest-growing fintech startups, valued at $6.4 billion as of June 2022.

What is the full form of CRED?

Cred doesn’t officially have a full form. While some have speculated it stands for “Credit Reward and Experience Drive,” the company itself hasn’t confirmed this interpretation. They simply chose “Cred” as a name that conveys trust, credibility, and exclusivity.

The Cred app is a financial technology (fintech) platform that offers credit card payment solutions, credit score monitoring, and other financial services.

Is CRED app legal?

The legality of the Cred app is not in question. Cred is an Indian fintech company founded in 2018 by Kunal Shah.

It offers a reward-based credit card payments app, along with other services such as house rent payments and short-term credit lines. Despite receiving some criticism, the app is a legitimate financial services platform.

Who is eligible for CRED?

To become a member of CRED, individuals need to have a credit score of more than 750.

Once this criterion is met, users can easily become a member and enjoy the benefits offered by the platform, such as credit card bill payment and reward points.

What is the minimum credit score for CRED?

Cred requires a good credit score, generally above 750, to be eligible for membership. So, if you aim to join their exclusive club, focus on building and maintaining a healthy credit score!

LATEST POST