Introduction

Are you looking for a reliable and innovative peer-to-peer lending platform in India? Look no further than LenDenClub.

As a personal finance expert, I understand the importance of leveraging the right tools to achieve your financial goals.

In this comprehensive review, we will explore the key features, benefits, and potential considerations of LenDenClub.

With its cutting-edge technology, transparent lending practices, and competitive interest rates, LenDenClub has emerged as a leading player in the Indian P2P lending market.

However it is important to do a detailed due diligence at your part.

By the end of this review, you will gain valuable insights to make informed decisions about integrating LenDenClub into your financial portfolio.

Join me as we unveil the future of personal finance with LenDenClub.

ALSO READ: P2P Lending In India- A Complete Guide

What is LenDenClub?

Lendenclub is a leading peer-to-peer lending platform in India that connects investors with creditworthy borrowers.

Registered users of the platform can lend money for set terms, usually between one and five years, and earn interest at rates that are competitive typically between ten and twelve percent annually.

Ownered by Innofin Solutions Pvt. Ltd., LenDenClub is a P2P-NBFC registered with the RBI that offers users a reliable and secure financial platform.

It’s crucial to remember that P2P investing carries dangers, thus choices on investments should be made carefully.

While some users have shared favorable experiences like consistently earning double-digit returns others have voiced worries over technological difficulties and the rate at which loans default.

As with any investment, prospective investors should carefully weigh the risks involved with P2P lending through platforms such as LenDenClub and perform extensive due research.

ALSO READ: 12% Club Review- Features, Advantage & Disadvantages

LenDenClub: FMPP Plan

Looking for a unique investment opportunity that combines diversification with potentially high returns?

Look no further than LenDenClub’s Fractional Matchmaking Peer-to-Peer (FMPP) Plan. This innovative plan, powered by cutting-edge technology, aims to balance risk and reward by offering investors:

- Hyper-Diversification: Divide your investment into micro-loans for various borrowers, minimizing the impact of defaults.

- Competitive Interest Rates: Earn potential returns of 10-12% per annum, significantly higher than traditional fixed-income options.

- Fixed Tenure: Invest for a specified period, ranging from 1 to 5 years, aligning with your financial goals.

LenDenClub’s intelligent algorithm plays a crucial role in the FMPP Plan.

It strategically allocates your investment across numerous loans, ensuring broad diversification and mitigating risk.

Remember, this doesn’t eliminate the possibility of defaults, but it significantly reduces their potential impact on your overall returns.

LenDenClub: Features

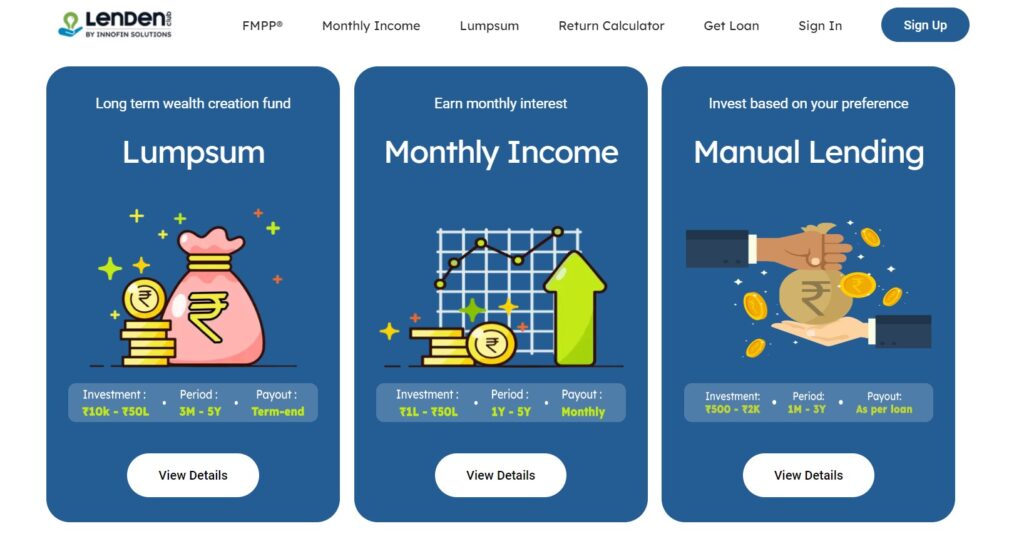

LenDenClub, a prominent peer-to-peer (P2P) lending platform in India, offers a range of features that cater to the diverse needs of both investors and borrowers.

Some of the key features of LenDenClub include:

- Competitive Interest Rates: The platform offers competitive interest rates, often around 14-15% percent per annum, providing an attractive investment opportunity for lenders.

- Digital Platform: LenDenClub operates as a primarily online platform, offering a seamless and user-friendly digital experience for its members.

- Risk Assessment Mechanisms: The platform employs robust risk assessment mechanisms to evaluate borrower profiles and creditworthiness, enhancing the security and reliability of the lending process.

- Transparent Lending Practices: LenDenClub prioritizes transparency in its lending practices, providing users with clear and comprehensive information about the investment and borrowing processes.

- Escrow Accounts: The use of escrow accounts to handle all investors’ funds adds an extra layer of protection and security for lenders.

- Diversification: The platform allows investors to diversify their investment across multiple borrowers, helping to mitigate risk and optimize returns

These features collectively contribute to LenDenClub’s reputation as a trusted and innovative P2P lending platform, offering valuable investment opportunities for lenders and accessible credit options for borrowers.

LenDenClub: Benefits

For investors, diversifying your investment across multiple borrowers can help mitigate risk and optimize returns.

Conducting thorough due diligence on borrower profiles and creditworthiness is essential for informed investment decisions.

On the borrower’s side, maintaining a healthy credit profile and fulfilling repayment obligations on time can enhance creditworthiness and unlock future borrowing opportunities.

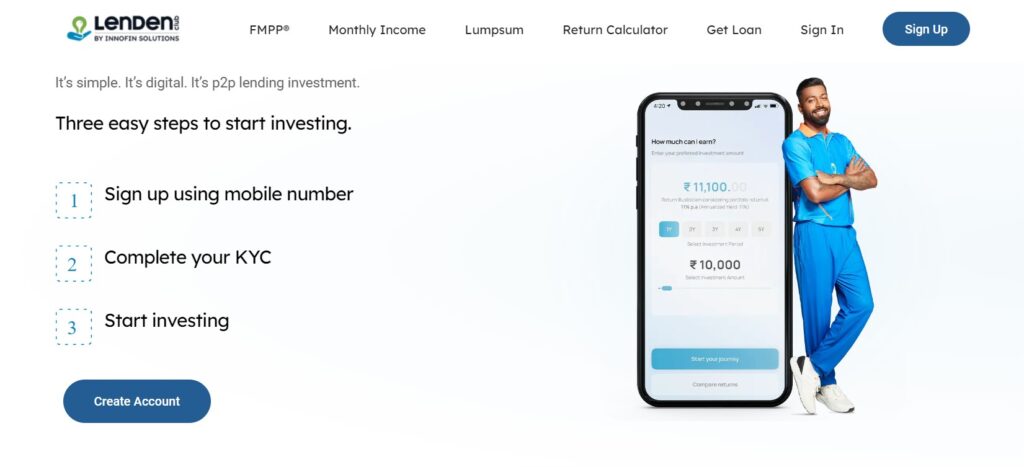

LenDenClub: Signup Process

Below image is self explanatory. Just follow the steps given below:

ALSO READ: Best Neo Banks In India- A Personal Guide

ALSO READ: 7 Guaranteed Ways To Improve Your CIBIL Score

LenDenClub: Risk Involved

The risks involved in LenDenClub include the possibility of fraud or credit default risk for the borrower, which is inherent in any lending activity.

While the platform puts efforts into sourcing the right borrowers and conducts thorough underwriting, information verification, and KYC checks, there is still a potential for borrower default.

Additionally, there is a collection risk, where the platform uses various channels to recover funds if a borrower does not repay, following all RBI-specified guidelines.

Another risk is the concentration risk, where a large number of borrowers from a particular geography or industry facing a downturn could impact the lender.

Furthermore, liquidity risk is a concern, as pulling out funds before the end of the investment period may not be easy.

It’s important for investors to understand the risks involved in P2P lending and factor them into their investment decisions.

LenDenClub’s platform fees and charges should also be considered to ensure effective operation of the P2P lending platform.

ALSO READ: Federal Scapia Credit Card Review- 100% Truth

LenDenClub: Alternatives

Being one of the top P2P lending platforms in India, LenDenClub faces competition from a number of companies.

These are a few of the rivals of LenDenClub:

- Faircent: With competitive interest rates and an easy-to-use interface, Faircent is a peer-to-peer (P2P) lending platform that links borrowers and lenders.

- Finzy: Finzy is a peer-to-peer lending platform that offers investors competitive returns on their investments and swift, hassle-free loans to borrowers.

- Lendbox: Lendbox is a peer-to-peer (P2P) lending network that links lenders and borrowers while providing both transparent lending procedures and low interest rates.

- I2IFunding: I2IFunding is a peer-to-peer lending platform that offers investors competitive returns on their investments while simultaneously giving borrowers fast and simple loans.

- RupeeCircle: RupeeCircle is a P2P lending platform with an intuitive user interface that links lenders and borrowers. It offers affordable interest rates.

- Cashkumar: Cashkumar is a peer-to-peer lending platform that offers investors competitive returns on their investments while simultaneously giving borrowers quick and simple loans.

These competitors offer similar services to LenDenClub, providing alternative investment opportunities for lenders and borrowers in the P2P lending space.

It’s important to conduct thorough due diligence and carefully consider the associated risks before participating in P2P lending through any platform.

LenDenClub Review: Final Verdict

In conclusion, Lendenclub is a significant advancement in the personal finance industry since it provides investors and borrowers with an easy-to-use platform.

By embracing the concepts of peer-to-peer lending, Lendenclub has democratized access to credit and investment options, empowering anyone to achieve their financial objectives.

As you manage the always shifting landscape of personal finance, consider the chance that Lendenclub could be a useful addition to your financial portfolio.

With a thoughtful and well-planned approach, Lendenclub may assist you in reaching your financial goals in today’s fast-paced, internationally interconnected society.

By incorporating Lendenclub into your financial plan, you may leverage innovation and technology to accelerate your financial achievement.

FAQs

Is LenDenClub safe to invest?

LenDenClub follows global standards of high-level data encryption/decryption protocols to ensure security and privacy.

However, P2P investment is subject to risks, and investment decisions are at the lender’s discretion.

LenDenClub does not guarantee the recovery of the loan amount from the borrower. It’s important for investors to carefully consider the associated risks and conduct thorough due diligence before investing.

Is LenDenClub RBI approved?

Yes, LenDenClub is approved by the Reserve Bank of India (RBI) and is registered as an NBFC-P2P (Non-Banking Financial Company – Peer to Peer) lending platform.

The platform complies with the Fair Practice Code set out by the RBI in its guidelines for NBFC-P2P, ensuring transparency and fairness in its dealings with customers.

LenDenClub follows global standards of high-level data encryption/decryption protocols to ensure security and privacy for its users. Therefore, it is a safe and regulated platform for P2P lending.

How does LenDenClub make money?

LenDenClub generates revenue by charging a platform fee on the loans disbursed through its platform.

The platform charges a fee of 1.5% to 4% of the loan amount, depending on the borrower’s creditworthiness and the loan tenure.

Additionally, the platform may charge a fee for late payments or loan prepayment.

LenDenClub has turned profitable and aims to cross Rs 1,200 crore disbursal in the current fiscal year.

The platform’s employees rate their compensation and benefits as 3.7 out of 5, according to anonymously submitted Glassdoor reviews

Is LenDenClub real or fake?

As a personal finance expert, I would advise caution when considering LenDenClub as an investment option.

While the platform offers the potential for attractive returns, there are significant concerns regarding the platform’s performance, including high non-performing asset (NPA) levels and challenges in loan recovery.

Additionally, the removal of portfolio performance data and the introduction of new products with fixed returns may raise questions about transparency and risk management.

It’s essential for investors to conduct thorough due diligence and carefully consider the associated risks before investing in platforms like LenDenClub

How do I withdraw money from LenDenClub?

You can withdraw funds from LenDenClub by logging into your account and placing a withdrawal request.

The amount will be credited to your registered bank account within 24 to 48 hours.

However, it’s important to consider the platform’s performance and associated risks before making any investment or withdrawal decisions.

What is the interest rate of LenDenClub?

LenDenClub offers a range of interest rates depending on the specific product or service.

For example, the platform’s P2P debt product offers a potential return of 10-12%.

Additionally, LenDenClub’s personal loans feature interest rates ranging from 6.5% to 20.95% for repayment tenures between 3 months and 2 years.

It’s important for potential investors and borrowers to carefully review the specific terms and conditions associated with each offering to make informed decisions.

When did LendenClub launch?

LenDenClub was launched in July 2015 as a primarily online platform operated by Innofin Solutions Pvt. Ltd. in the peer-to-peer lending industry in India.

What is the default rate of LendenClub?

The default rate at LenDenClub has been reported to be around 2-6% according to the platform’s claims.

However, there are conflicting reports, with some users stating that the NPA (Non-Performing Assets) level was close to 30-40% during a specific period, and efforts to collect the money were not evident.

It’s important for potential investors to carefully consider these varying perspectives and conduct thorough due diligence before making investment decisions.

LATEST POST

Flow Book Summary: By Mihaly Csikszentmihalyi