Quick Summary: A user-friendly, affordable investment platform with a wide range of products, advanced trading platforms, and personalized investment advice. As a personal finance expert, I’ve had a great experience with HDFC Sky’s quick account opening process and helpful customer support. The low brokerage fees and educational resources have helped me save money and improve my trading skills. I highly recommend HDFC Sky for a secure and prosperous future

Introduction

Navigating the world of online brokerage can feel like scaling Mount Everest in flip-flops.

Complex fees, hidden charges, and outdated interfaces often leave you gasping for air.

But what if there was a platform designed to simplify your journey, offering breathtaking views without the avalanche of costs?

Enter HDFC Sky, a new player in the Indian brokerage scene promising a sleek, transparent, and cost-effective experience.

Buckle up, fellow investors, because this HDFC Sky review will dissect its features, uncover its potential pitfalls, and ultimately help you decide: is it your Everest sherpa, or just a scenic overlook?

HDFC Sky: A Brief Overview

Launched in September 2023, HDFC Sky is the brainchild of HDFC Securities, a well-established name in the Indian financial landscape.

Their mission is to cater to the growing demand for technology-driven, cost-conscious investing.

So, what sets them apart from the Sherpas already crowding the base camp?

ALSO READ: Choice Broking Review: Flat-Fee Hero or Myth Maker?

ALSO READ: FYERS Review | Brokerage Charges, Margin, Trading

ALSO READ: Cred Review || Is Cred App Safe to Use

HDFC Sky Review: Pros

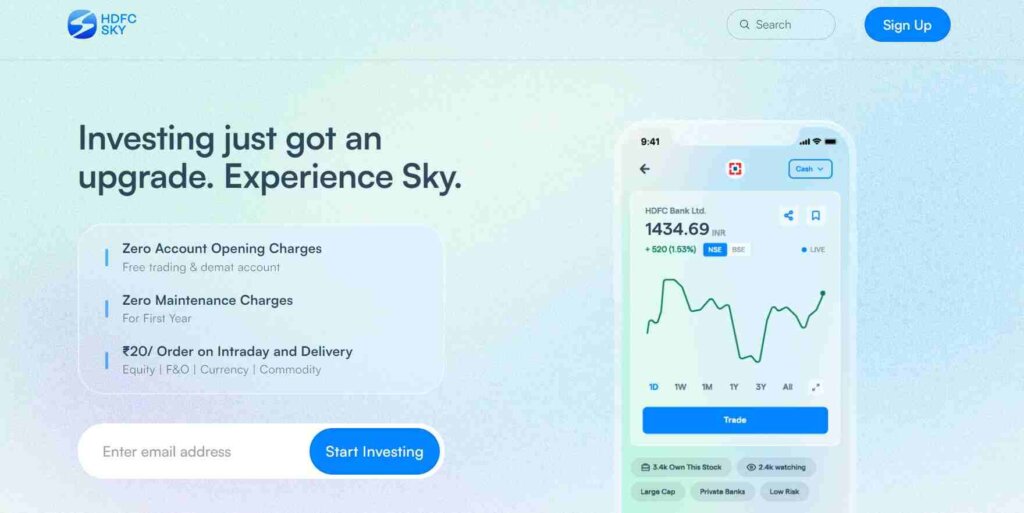

Flat Fee Structure

Unlike traditional brokers who charge a percentage of your trade value, HDFC Sky boasts a flat fee of Rs. 20 per order, regardless of size or segment.

This transparent pricing lets you focus on your strategies, not worrying about fees nibbling away at your profits. Imagine scaling Everest knowing exactly how much each step costs – liberating, right?

Wide Range Of Products

HDFC Sky offers a diverse range of investment products, including mutual funds, stocks, bonds, and more.

This variety allows investors to build a well-rounded portfolio that meets their specific needs and goals.

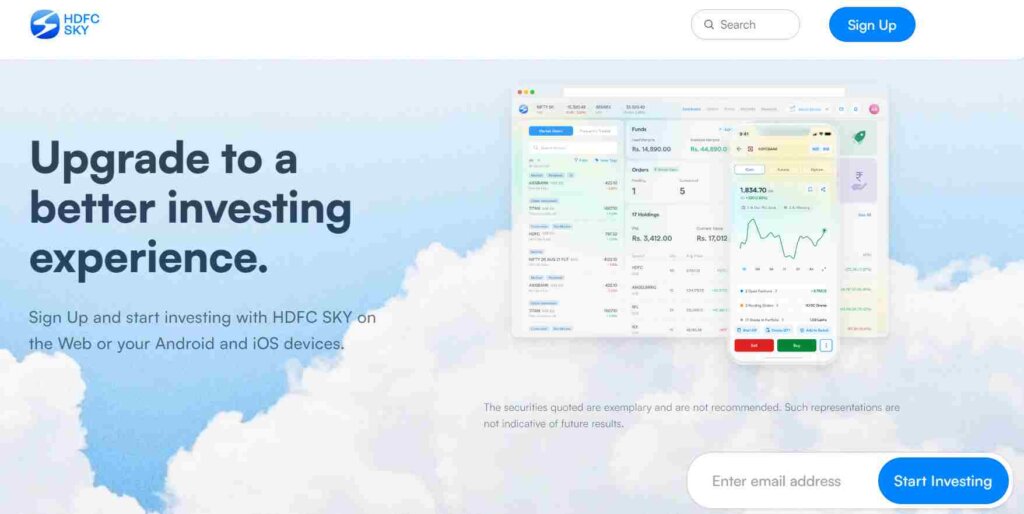

Advanced trading platforms

HDFC Sky provides a web platform, desktop platform, and mobile platform, as well as support for TradingView.

These platforms are user-friendly and offer a range of features to help investors make informed decisions.

Educational Resources

HDFC Sky offers a range of educational resources, including modules on basic and technical analysis, commodities, currencies, options, futures, and more.

These resources are designed to help investors improve their knowledge and skills.

Robust Community

The climb can get lonely. HDFC Sky fosters a vibrant community forum where you can connect with fellow investors, share experiences, and learn from each other.

Imagine swapping stories around a virtual campfire, gaining valuable insights from seasoned climbers and forging connections that enrich your journey.

Personalized Investment Advice

HDFC Sky offers personalized investment advice through its team of experienced financial advisors.

These advisors can help investors build a customized investment plan that meets their specific needs and goals.

ALSO READ: LenDenClub Review || P2P Lending Platform In India

ALSO READ: 12% Club Review- Features, Advantage & Disadvantages

HDFC Sky Review: Cons

While the view from the peak might be enticing, every climb comes with its risks.

Here are some potential pitfalls to consider before embarking on your journey with HDFC Sky:

Limited Product Offerings

Currently, HDFC Sky doesn’t offer mutual funds or fixed-income investments.

If you seek a one-stop shop for all your financial needs, this might not be your summit.

Remember, choosing the right Sherpa depends on your individual goals and the specific terrain you want to conquer.

Limited Global Reach

As of now, HDFC Sky caters only to Indian residents.

If your investment aspirations have a global outlook, you might need to look elsewhere for your guide.

Remember, some mountains are best explored with Sherpas who know the international ropes.

Limited Customer Support

Compared to traditional brokers, HDFC Sky’s customer support options are limited.

While they offer email and chat support, phone support is currently unavailable.

Remember, even the most experienced climbers can benefit from a quick call to their guru/ mentor in case of an unexpected blizzard.

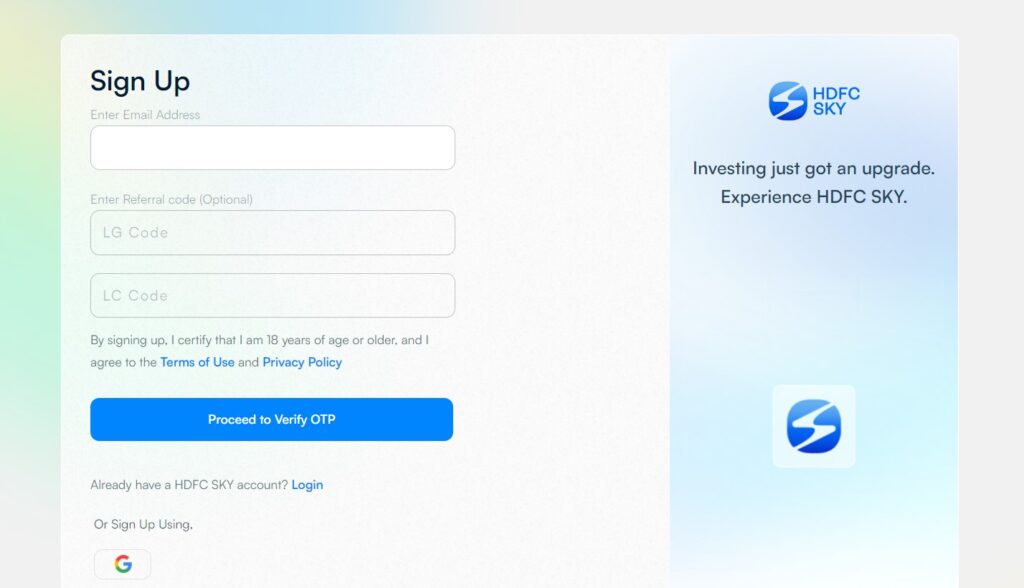

HDFC Sky’s Account Opening Process

The procedure of opening an account with HDFC Sky is simple and quick. The actions that you must take are as follows:

- Click the ‘Open An Account’ option on the home page of the HDFC Sky website.

- After entering your name, email address, and mobile number, click “Submit.”

- Fill up the online application with the required information, and submit scanned copies of your address proof, income proof (for derivatives trading), and PAN card

- Your client ID and password will be included in a welcome email that HDFC Sky sends you 24 hours after you submit the online account opening application.

- Finish the in-person verification (IPV) process, in which an authorized HDFC Sky staff meets with you or uses a webcam to confirm your identity.

HDFC Sky’s Brokerage Charges

HDFC Sky charges the following brokerage fees:

- Equity Delivery: Free

- Equity Intraday: ₹20 per executed order or 0.03% whichever is lower

- Equity Futures: ₹20 per executed order or 0.03% whichever is lower

- Equity Options: ₹20 per executed order

- Currency Futures: ₹20 per executed order or 0.03% whichever is lower

- Currency Options: ₹20 per executed order

- Commodity Futures: ₹20 per executed order or 0.03% whichever is lower

- Commodity Options: ₹20 per executed order

Additionally, HDFC Sky charges government taxes and fees, which are shown in the contract note sent to the customer at the end of the day.

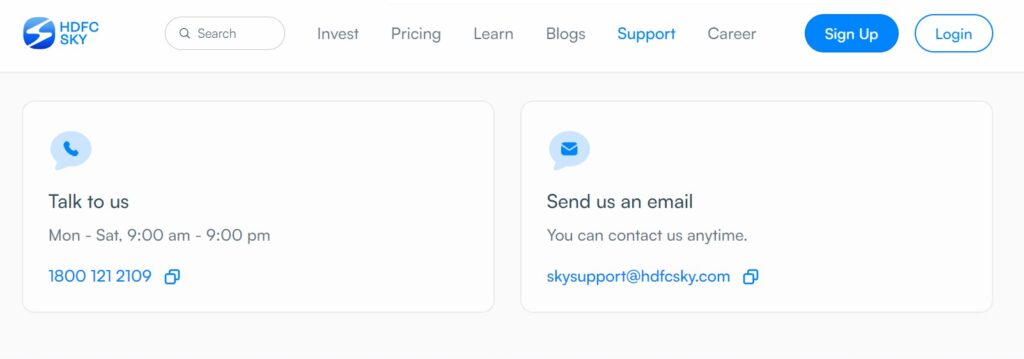

HDFC Sky’s Customer Care Info

There are several ways to contact HDFC Sky’s customer service representatives. To get in touch with HDFC Sky customer service, use these methods:

- Email: You can email HDFC Sky customer support at support@hdfcsecurities.com for any queries or issues.

- Phone: You can call HDFC Sky customer support at +91 22 6799 9999/ 1800 121 2109 for any assistance.

- Help Center: HDFC Sky has a help center on their website where you can find answers to frequently asked questions and submit a support ticket for any issues.

Conclusion: My Experience

To sum up, HDFC Sky is an excellent platform for investing that provides a vast array of goods, sophisticated trading tools, and tailored investment guidance.

I have had nothing but positive experiences with HDFC Sky as a personal finance expert.

My account was opened quickly and simply, and I could always get in contact with their customer service department with any questions I had.

I value HDFC Sky’s array of educational resources, since they have assisted me in honing my trading abilities.

I have also been able to save money on my trades because to the reduced brokerage fees, which is always a benefit.

All things considered, I heartily endorse HDFC Sky to anyone searching for a trustworthy and reasonably priced investing platform.

With HDFC Sky, you have the tools and resources you need to achieve your financial goals and build a secure and prosperous future.

FAQs

Is HDFC SKY app safe?

Yes, HDFC Sky app is safe and secure for investors.

HDFC Sky is a SEBI registered discount stockbroker and a BSE, NSE, and MCX registered trading member and a depository participant with CDSL and NSDL.

The app provides fingerprint authentication-based biometric login access to users to prevent any unauthorized access.

Additionally, all private and confidential customer data are protected by 256 AES encryption.

HDFC Sky also offers personalized investment advice through its team of experienced financial advisors.

The app is free for all HDFC Sky customers, and there are no charges to use the mobile trading platform.

Overall, HDFC Sky is a reliable and secure investment platform that offers a wide range of products and services to meet the needs of modern investors.

What is the use of HDFC SKY?

The HDFC Sky app is a comprehensive investment platform that allows users to trade in Indian stocks, F&O, commodities, currencies, mutual funds, and US stocks.

It offers a crystal-clear interface, extensive fundamental and technical research, real-time market statistics, news & events, and the ability to place advanced complex orders like bracket order (BO), cover order (CO), One cancel others (OCO), and basket orders.

Who owns HDFC SKY?

HDFC Sky is a discounted broking app introduced by HDFC Securities, a subsidiary of HDFC Ltd.

It offers a flat pricing model of Rs 20 per order for various investment options, including Indian equities, mutual funds, equity derivatives, commodities, currencies, US stocks, and fixed-income instruments.

How can I withdraw money from HDFC SKY?

To withdraw funds from HDFC Sky, follow these steps:

- Log in to your HDFC Sky account.

- Navigate to the “Funds Transfer” section.

- Select “Add and Withdraw Funds” or “Transfer Funds.”

- Choose the bank account you wish to transfer funds to.

- Enter the amount you wish to withdraw.

- Confirm the transaction.

It will take between 24 and 48 hours for the monies to be sent to your bank account, depending on the bank’s processing schedule.

HDFC Sky is a simple and safe platform for managing your assets because it lets you add and remove money from your bank account with just one click.

What is margin in HDFC SKY?

In HDFC Sky, margin is the amount of money borrowed from the broker to purchase stocks, allowing investors to increase their buying power.

This enables investors to trade in larger quantities than they could afford with their own capital, amplifying potential returns but also increasing the risk of losses.

The margin trading facility (MTF) allows investors to buy stocks by paying a small initial amount, with the rest funded by the broker, to be paid back by the investor in installments.

The margin requirement is decided by the broker, and the broker charges an interest rate on the borrowed amount.

Margin trading can be used for various purposes, including equity intraday, futures & options writing (equity and currency F&O), and more.

It is essential for investors to be cautious when using margin trading, as it can lead to amplified losses if the market moves against their positions.

What is the AMC charges for HDFC SKY after 1 year?

HDFC Sky’s annual maintenance charges (AMC) for a Demat account are free for the first year after opening the account.

After the first year, the AMC is Rs. 300 per year

How long does it take to get HDFC SKY payout?

The payout time for HDFC Sky depends on the withdrawal method chosen by the user.

HDFC Sky allows fund withdrawal only through bank transfer, which takes 24-48 hours to process.

Once the withdrawal request is processed, the funds are credited to the user’s bank account.

HDFC Sky charges a fee of ₹10 each time a fund withdrawal request is placed.

It is important to note that the withdrawal fee is subject to change, and users should check the latest fee structure on the HDFC Sky website or app.

Does HDFC SKY offer direct mutual fund?

No, HDFC Sky does not offer direct mutual funds.

The platform only provides regular mutual funds, and not direct plans.

However, HDFC Sky offers a wide range of investment options, including Indian equities, mutual funds, equity derivatives, commodities, currencies, US stocks, and fixed-income instruments.

The platform is equipped with a secure mobile app, offering features like fingerprint authentication-based biometric login access and extensive fundamental and technical research.

Additionally, HDFC Sky provides personalized investment advice through its team of experienced financial advisors.

Overall, HDFC Sky is a promising entrant in the discounted broking space, providing a comprehensive and convenient platform for investors and traders.

My Social Links: Quora, Facebook, Linkedin, Pinterest, X (Twitter)