Introduction

Are you looking for a fixed deposit alternative that offers attractive interest rates and flexible withdrawal policies?

Look no further than Mobikwik Xtra!

In this comprehensive review, I’ll explore the features, benefits, and drawbacks of Mobikwik Xtra and help you decide if it’s the right investment option for you.

Are you ready to learn more about this innovative investment platform and how it can help you maximize your earnings and streamline your finances? Let’s dive in!

What is Mobikwik Xtra?

Mobikwik Xtra is a fixed deposit alternative offered by Mobikwik, a leading digital wallet and payment platform in India. It allows users to invest their money for a fixed period and earn attractive interest rates on their deposits. Mobikwik Xtra offers flexible withdrawal policies, allowing users to withdraw their money at any time without any penalty or charges.

Also Read: P2P Lending In India- A Complete Guide

Mobikwik Xtra Review: Founders

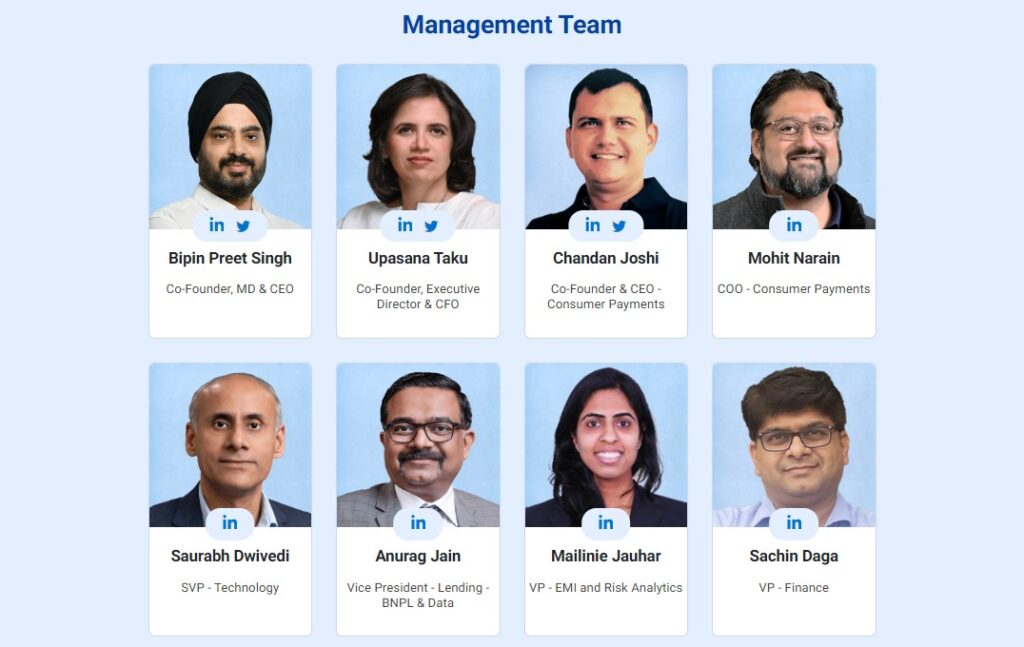

The founders of Mobikwik are Bipin Preet Singh and Upasana Taku, a husband-and-wife duo who established the company in 2009.

Both Singh and Taku come from diverse backgrounds:

- Bipin Preet Singh: Graduated from IIT Delhi in 2002 with a degree in Electrical Engineering. Prior to Mobikwik, he worked as a Platform Architect at Intel, Nvidia, and Freescale. His vision for Mobikwik was to improve mobile recharge options in India.

- Upasana Taku: Holds a degree in Mathematics from Lady Shri Ram College for Women, Delhi. She initially worked in the field of journalism and advertising before joining Mobikwik. Her expertise has been crucial in shaping the company’s user interface and experience.

Together, they have steered Mobikwik from a website offering mobile recharges to a multifaceted fintech platform offering payments, investments, credit, and other services. Their entrepreneurial spirit and combined skills have been instrumental in Mobikwik’s growth and success.

Mobikwik Xtra Review: Business Model?

Building upon the previous overview, let’s delve deeper into Mobikwik Xtra’s business model and explore its intricacies:

Key Revenue Streams

- Origination Fees: As mentioned earlier, Mobikwik Xtra charges a loan origination fee to borrowers, typically ranging from 1-3%. This fee covers loan processing, credit assessment, and platform maintenance costs.

- Service Fees: Investors incur a service fee, usually around 0.5-1%, for using the platform, managing their investments, and accessing features like automated investment options.

- Late Payment Penalties: Borrowers who default incur late payment penalties, generating additional revenue for Mobikwik Xtra. This incentivizes timely repayments and mitigates potential losses.

- Data Analytics and Credit Scoring: Mobikwik Xtra leverages its data insights and credit scoring capabilities to offer additional services like loan pre-qualification and personalized investment recommendations. These services can be monetized through subscription fees or partnerships with financial institutions.

Value Proposition for Borrowers

- Accessibility: Mobikwik Xtra caters to underbanked or credit-constrained individuals and small businesses, providing access to funding that might be unavailable through traditional channels.

- Faster Loan Processing: The platform aims for quicker loan approvals compared to banks, which can be crucial for businesses and individuals needing urgent financing.

- Flexible Loan Options: Mobikwik Xtra offers a variety of loan products with different interest rates, tenures, and repayment options, catering to diverse borrower needs.

Value Proposition for Investors

- High Potential yields: With potential yields of up to 24% annually, Mobikwik Xtra offers substantially better returns than conventional investments like fixed deposits. Higher yielding investors are drawn to this.

- Diversification: To reduce risk and spread their investment exposure, investors can diversify their portfolios by making several loan investments in a range of industries, risk profiles, and loan sizes.

- Low investing Threshold: Unlike other traditional investing alternatives, Mobikwik Xtra accepts investments as low as Rs. 1,000, making it accessible to a wider variety of investors.

Challenges and Considerations

- Credit Risk Management: The ability of Mobikwik Xtra to reduce borrower defaults and successfully manage credit risk is critical to the platform’s success. Strong credit evaluation procedures, diversification plans, and possible risk-sharing arrangements are all part of this.

- Regulatory Compliance: In order to maintain transparency and safeguard investors, Mobikwik Xtra must abide by a number of laws and regulations, which are specific to the P2P lending sector in India.

- Competition: There are several companies fighting for market share in the increasingly competitive P2P lending sector. Mobikwik Xtra must set itself apart with its features, technological prowess, and investor confidence.

Mobikwik Xtra’s business model offers a compelling value proposition for both borrowers and investors. However, navigating the challenges of credit risk management, regulatory compliance, and fierce competition will be critical for its long-term success. Understanding these factors is crucial before making any investment decisions on the platform.

Also Read: Cred Review || Is Cred App Safe to Use

Mobikwik Xtra Review: Factors to Consider Before Investing

Before investing in Mobikwik Xtra, it’s important to assess your risk tolerance and investment goals. Consider how Mobikwik Xtra fits into your overall investment strategy and whether it aligns with your financial objectives. Additionally, compare Mobikwik Xtra with other investment options available to you, taking into account factors such as liquidity, returns, and risk.

It’s also crucial to carefully review the terms and conditions of Mobikwik Xtra, including any fees or charges associated with investing and withdrawing funds. By conducting thorough research and due diligence, you can make an informed decision that’s in line with your financial needs and aspirations.

Mobikwik Xtra Review: Pros & Cons

So, should you jump on the Mobikwik Xtra bandwagon? Before you do, let’s weigh the pros and cons:

Mobikwik Xtra Review: Pros

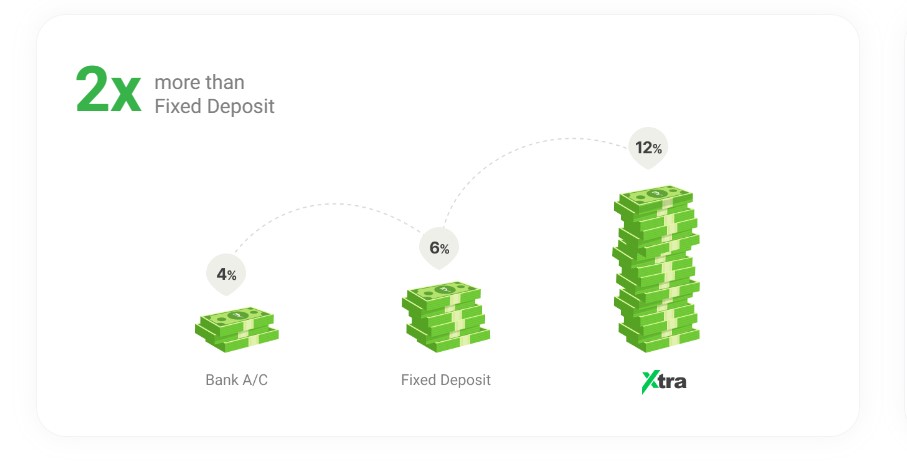

- Potentially High Returns: Compared to traditional investments like fixed deposits, Mobikwik Xtra boasts tempting interest rates, reaching up to 24% p.a.

- Diversification: Spread your wings! Mobikwik Xtra helps you diversify your portfolio beyond stocks and bonds, potentially mitigating risk.

- Convenience: The user-friendly platform makes investing easy and accessible through the Mobikwik app.

- RBI Regulation: A layer of comfort – Mobikwik Xtra operates under the watchful eye of the Reserve Bank of India.

Mobikwik Xtra Review: Cons

- Higher Risk: Remember, higher returns often come with higher risks. In this case, the risk of borrowers defaulting on their loans.

- Limited Track Record: Mobikwik Xtra is relatively new, making its long-term performance uncertain.

- Dependence on Borrowers: Your returns directly depend on borrowers’ creditworthiness and timely repayments. Not exactly a sure thing.

Also Read: LenDenClub Review || P2P Lending Platform In India

Mobikwik Xtra Review: Responsible Investing

If you’re still considering Mobikwik Xtra, tread cautiously and follow these golden rules:

- Start Small: Don’t go all-in. Begin with a small investment to understand the platform and assess your comfort level with risk.

- Diversify Within P2P: Don’t put all your eggs in one basket. Spread your investments across different borrowers and loan terms.

- Research is King: Do your homework! Understand your chosen borrowers’ creditworthiness and repayment history.

- Emergency Funds Off-Limits: Only invest what you can afford to lose. P2P lending is not a guaranteed income source.

Mobikwik Xtra Review: Products Offered

Think Mobikwik Xtra is all about borrowing and lending? Think again! It’s more like a financial playground with cool features and products to explore.

Buckle up, because we’re about to dive in!

- Flexi: Wanna invest and have the freedom to withdraw anytime? Flexi is your buddy! It’s like a flexible savings account, offering interest rates of 10-18% p.a. on loans with terms of 3 months or more. Perfect for dipping your toes in the P2P lending pool.

- Plus: Feeling adventurous? Plus offers fixed-tenure investments (6 months to 3 years) with potentially higher returns (up to 24% p.a.). Think of it as a fixed deposit with a juicy bonus, but remember, early withdrawals come with a penalty.

- Mutual Funds: Feeling like diversifying your portfolio? Mobikwik Xtra has got you covered! Invest in various mutual funds directly through the platform, putting your eggs in different baskets for a smoother financial ride.

- Digital Gold: Want some gold bling without the hassle? Mobikwik Xtra lets you buy and store digital gold, offering a hedge against inflation and adding some sparkle to your portfolio.

- Auto Invest: Feeling overwhelmed by the options? Set your choices and let the Auto Invest feature work its magic, investing your money based on the criteria you specify. Easy peasy!

- Secondary Market: Have you taken out a loan but need the money sooner? Sell it in the secondary market to other investors, releasing some liquidity before the loan matures.

- Portfolio Management Tools: Keep track of your investments, assess their performance, and receive individualized advice so you can manage your portfolio like an expert. Mobikwik Xtra serves as a personal financial advisor.

While Mobikwik Xtra offers exciting options, it’s crucial to understand that P2P lending involves risks.

Do your research, invest responsibly, and don’t put in what you can’t afford to lose. But hey, with a little knowledge and the right tools, Mobikwik Xtra can be your gateway to a more rewarding financial future!

Also Read: FYERS Review | Brokerage Charges, Margin, Trading

Mobikwik Xtra Review: Eligibility Criteria

To open a Mobikwik Xtra account, users must meet certain eligibility criteria, including:

- KYC Documents: Users must provide valid KYC documents, such as Aadhaar card, PAN card, or passport.

- Minimum Investment Amount: Users must invest a minimum amount of Rs. 1,000 to open a Mobikwik Xtra account.

Mobikwik Xtra Review: How to Invest

To invest in Mobikwik Xtra, follow these steps:

- Complete KYC: Ensure you have completed your PAN and Aadhar-based KYC.

- Investment Limit: Start investing with as little as Rs. 1000 and up to Rs. 10 lakhs.

- Higher Investments: Contact Mobikwik if you wish to invest more than Rs. 10 lakhs.

- Net Worth Certificate: For investments exceeding Rs. 10 lakhs, a net worth certificate is required as per RBI standards.

- No Fees: Mobikwik Xtra does not charge any fees or commission for deposits or withdrawals.

- Earnings Compounding: Your interest income is not reinvested; it is credited to your account, which you can withdraw at any time.

- Tax Implications: Interest income earned is categorized under “Other Income” and taxed according to your income tax bracket

Mobikwik Xtra Review: Case Studies and User Experiences

To provide insights into the practical aspects of investing in Mobikwik Xtra, let’s take a look at some real-life examples of individuals who have invested in the platform.

Case Study 1

Rahul, a young IT professional working in Noida, decided to invest a portion of his savings in Mobikwik Xtra to earn higher returns.

Over the course of six months, Rahul was able to earn attractive interest on his investments, helping him achieve his financial goals faster than he had anticipated.

Case Study 2

Priya, a small business owner in Kanpur, was initially skeptical about investing in Mobikwik Xtra due to concerns about security and reliability.

However, after conducting thorough research and consulting with financial experts, Priya decided to give it a try.

To her delight, Priya found that investing in Mobikwik Xtra was easy and convenient, and she was able to earn competitive returns on her investments.

What is the alternative to MobiKwik Xtra?

Though Mobikwik is a good option to consider, there are other companies in the same space.

Few of them are mentioned below:

- India P2P: Connecting lenders and borrowers directly, India P2P offers alternative investment options within regulatory guidelines set by the Reserve Bank of India (RBI).

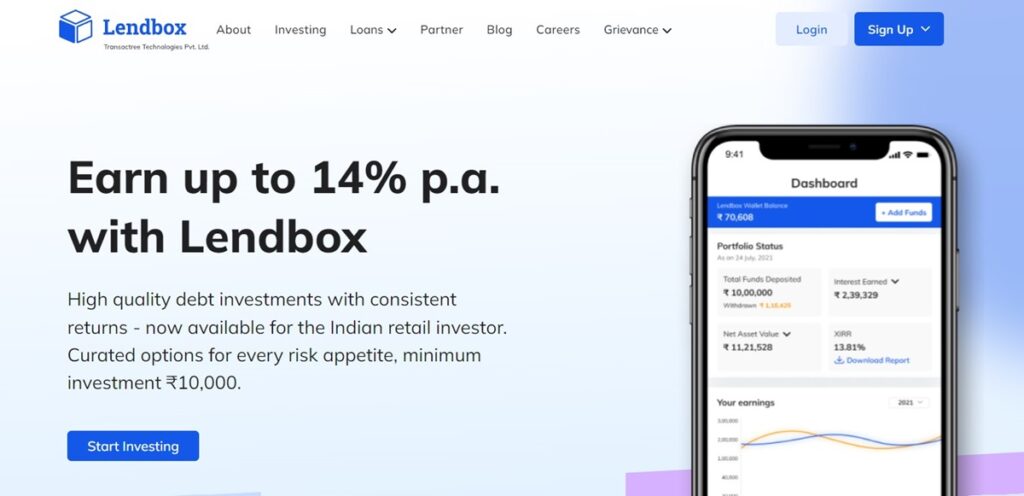

- Lendbox: An RBI-certified Non-Banking Financial Company (NBFC) specializing in peer-to-peer lending, Lendbox provides a diverse range of investment opportunities.

- AltFi: Providing access to a variety of alternative investment classes, AltFi enables investors to diversify their portfolios beyond traditional assets.

- Upward Finance: Focusing on consumer loans, Upward Finance offers a robust platform for peer-to-peer lending, aiming to deliver strong returns to investors.

- Groww: Groww is a popular investment application that offers a wide range of mutual fund schemes, stocks, and bonds, empowering investors to build a balanced portfolio.

- Faircent: Faircent is another popular P2P lending platform that offers a wide range of loan options. It has a user-friendly interface and a strong focus on transparency, making it a good choice for both experienced and new investors.

- BharatPe 12% Club: BharatPe 12% Club is a P2P lending platform that offers a fixed return of 12% per annum on all investments. It is a good option for investors who are looking for a safe and stable investment with a guaranteed return.

- CRED Mint: CRED Mint is a P2P lending platform that is backed by the CRED platform. It offers a variety of investment options with attractive interest rates. It is a good option for investors who are already familiar with the CRED platform and trust its brand.

- Scripbox: Scripbox simplifies the investment journey by creating customized portfolios tailored to individual risk preferences and financial objectives.

- NeoTribe: NeoTribe is a P2P lending platform that focuses on social impact investing. It allows investors to lend money to businesses and individuals that are working to solve social and environmental problems. It is a good option for investors who want to make a positive impact with their investments.

When choosing a P2P lending platform, it is important to consider your investment goals, risk tolerance, and the fees charged by the platform. It is also important to do your research on the platform and the borrowers before making any investments.

Mobikwik Xtra Vs BharatPe 12% Club

Here’s a comparison grid highlighting the key features and offerings of Mobikwik Xtra and BharatPe 12% Club:

| Features | Mobikwik Xtra | BharatPe 12% Club |

|---|---|---|

| Investment Options | Mutual Funds, Fixed Deposits, Digital Gold, SIPs, Insurance, NPS, Stocks and ETFs | Fixed Deposits, Savings Account with 12% Interest Rate |

| Accessibility | Available through the Mobikwik app | Available through the BharatPe app |

| Mutual Fund Selection | Offers a variety of mutual funds from different asset management companies | Not applicable, as BharatPe 12% Club primarily focuses on fixed deposits and savings accounts |

| Interest Rate | Varies depending on the investment option chosen | Offers a flat 12% interest rate on savings accounts |

| Risk Level | Depends on the investment option selected | Relatively lower risk with fixed deposits and savings accounts |

| Insurance Offerings | Provides various insurance products including life, health, and general insurance | Not applicable, as BharatPe 12% Club does not offer insurance products |

| Retirement Planning | Offers National Pension System (NPS) for retirement planning | Not applicable |

| Stock Market Participation | Allows investment in individual stocks and ETFs | Not applicable |

| Digital Gold | Enables buying and selling of digital gold | Not applicable |

| Convenience | All-in-one platform for managing finances and investments | Focuses primarily on fixed deposits and savings accounts for simplicity |

| Customer Support | Offers customer support through the Mobikwik app and website | Offers customer support through the BharatPe app and website |

Also Read: InCred Money Review | Alternate Investment Platform

Mobikwik Xtra Vs Lendbox

Here’s a simplified comparison grid for Mobikwik Xtra and Lendbox. This will certainly help you take a judicious decision.

| Feature | Mobikwik Xtra | Lendbox |

|---|---|---|

| Type | Financial services platform | Peer-to-peer lending platform |

| Investment Options | Mutual funds, fixed deposits, digital gold, SIPs, insurance, NPS, stocks, ETFs | Personal loans, business loans, education loans, vehicle loans, medical loans, etc. |

| Risk Level | Varies depending on investment option | Depends on the creditworthiness of borrowers |

| Returns | Potential for returns depending on investment performance | Interest earned on loans provided |

| Minimum Investment | Varies depending on the investment option | Varies depending on the loan type and amount |

| Regulation | Regulated by relevant financial authorities | Subject to peer-to-peer lending regulations |

| Liquidity | Varies depending on the investment option | Loans may have fixed tenures or early repayment options |

| Accessibility | Available through the Mobikwik app | Available through the Lendbox platform |

| Fees/Charges | May include fees such as transaction fees, management fees, etc. | Fees may include processing fees, interest rates, etc. |

| Purpose | Helps users grow their savings and investments | Provides loans to individuals and businesses |

Also Read: Choice Broking Review: Flat-Fee Hero or Myth Maker?

Conclusion: Is it right for you?

Look, there’s no one-size-fits-all answer. Mobikwik Xtra can be a lucrative option for risk-tolerant investors seeking diversification. But remember, higher potential rewards come with higher potential risks.

If you prioritize stability and security, stick to tried-and-true methods. But if you’re an adventurous soul with a well-diversified portfolio and a healthy appetite for risk, Mobikwik Xtra might be worth exploring.

Ultimately, the decision rests with you. Do your research, understand the risks, and invest wisely. Remember, your financial journey is your own, and only you can take the wheel.

As for me, I’ll keep a watchful eye on Mobikwik Xtra. This P2P platform might just be the next big thing, or it might fade into obscurity. Only time will tell!

FAQs

Is Xtra in MobiKwik safe?

As a seasoned personal finance expert, I can assure you that Xtra in MobiKwik is designed with robust security measures to safeguard your investments.

With stringent regulatory compliance and partnerships with reputable financial institutions like Lendbox, Mobikwik Xtra offers a secure platform for peer-to-peer lending.

However, like any investment, there are inherent risks involved, such as borrower defaults or market fluctuations.

It’s essential to diversify your investments, conduct thorough research, and only invest funds you can afford to potentially lose.

By staying informed and making prudent investment decisions, you can navigate the investment landscape with confidence and peace of mind.

What are the benefits of MobiKwik Xtra?

If you’re searching for new ways to boost your savings and generate passive income, look no further than Mobikwik Xtra!

This innovative investment platform offers a host of benefits that will leave you feeling confident and excited about your future.

- Competitive interest rates: Enjoy returns of up to 12% annually, beating many traditional banking options.

- Flexible investment options: Begin with as little as Rs. 1000 and scale up as you please.

- Diverse investment portfolio: Spread your wealth across multiple borrowers, mitigating risk.

- User-friendly interface: Monitor your investments anytime, anywhere, using the mobile app or web portal.

- Secured transactions: Partnering with Lendbox, an RBI-approved platform, ensures your investments remain safe and sound.

- Control and flexibility: Customize your investment strategy to fit your needs and comfort level.

With Mobikwik Xtra, you can take advantage of the latest trends in peer-to-peer lending, unlocking new opportunities for growth and prosperity.

So, why wait? Jump aboard the Mobikwik Xtra train and watch your dreams turn into reality!

Is there any charges in MobiKwik Xtra?

No Hidden Costs with Mobikwik Xtra!

Good news, fellow investors! When it comes to Mobikwik Xtra, you’ll be thrilled to hear that there are absolutely no hidden costs or fees attached to your investments. Whether you’re depositing funds or withdrawing profits, Mobikwik Xtra keeps things straightforward and transparent, leaving more room for you to focus on growing your wealth.

Is MobiKwik trusted?

Yes, MobiKwik is indeed a trustworthy brand in the world of digital payments and financial services.

With over a decade of experience, MobiKwik has built a solid reputation backed by strict adherence to industry norms and security protocols.

Millions of customers rely on MobiKwik for seamless transactions, and the company continues to innovate and expand its product offerings to serve its growing customer base.

As a seasoned personal finance expert, I highly recommend MobiKwik for its reliability, safety, and convenience.

Is Mobikwik RBI approved?

Yes, Mobikwik Xtra is backed by Lendbox, an RBI-approved non-banking financial company (NBFC), ensuring a secure and regulated investment environment.

When it comes to managing your hard-earned money, peace of mind matters, and partnering with a reputable organization like Lendbox helps safeguard your interests.

Does Mobikwik zip affect CIBIL score?

As a seasoned personal finance expert, I can assure you that Mobikwik Zip does have the potential to impact your CIBIL score.

Any credit activity, including opting for services like Mobikwik Zip, can influence your creditworthiness.

Timely payments and responsible credit usage can positively impact your CIBIL score, showcasing your financial reliability.

On the flip side, defaults or delays in payments could have a negative effect. It’s essential to manage your credit obligations diligently to maintain a healthy credit score and financial well-being.

Remember, staying informed and proactive about your credit activities is key to safeguarding your financial reputation.

Who is the owner of MobiKwik?

Bipin Preet Singh and Upasana Taku are the proud founders of MobiKwik.

Their vision and dedication have propelled MobiKwik to become a leading digital wallet and payment platform in India.

More details are given in the main body of this blogpost.

Which bank is responsible for MobiKwik?

MobiKwik doesn’t have a specific bank that’s responsible for it like a traditional bank account.

Instead, MobiKwik is a digital wallet and financial services platform that partners with various banks and financial institutions to provide its services.

When you use MobiKwik, you can link your bank account or add money to your MobiKwik wallet from your bank account.

So, in a way, you’re the boss of your money, and MobiKwik acts as the bridge between you and your bank, making transactions and managing your finances more convenient and accessible.

It’s like having a trusty sidekick that helps you navigate the world of digital payments effortlessly!

Will MobiKwik refund money?

Yes, MobiKwik has a refund policy in place to ensure customer satisfaction.

If you encounter any issues with a transaction or service, you can reach out to their customer support team for assistance.

They are dedicated to resolving any concerns promptly and ensuring that refunds are processed efficiently.

Rest assured, MobiKwik values its customers and strives to provide a seamless and reliable experience for all users.

Is MobiKwik a Chinese app?

No, MobiKwik is not a Chinese app. It is an Indian digital payments platform founded in 2009. Here are some key points to remember:

- Origins: MobiKwik was established in India, with its headquarters in Gurgaon, Haryana.

- Ownership: The company is majority-owned by Bipin Preet Singh, an Indian entrepreneur.

- Operations: MobiKwik operates solely in India, offering services like online payments, mobile recharges, bill payments, digital wallets, and financial investments.

In the past, some confusion arose because of the Indian government’s bans on certain Chinese apps.

However, MobiKwik has always been an Indian company and is not included in such lists.

It even capitalized on the situation by running ads highlighting its Indian roots and encouraging users to switch from “221st” Chinese app.

So, if you’re looking for an Indian digital payments platform, MobiKwik is a legitimate and popular option.

Is MobiKwik legal in India?

Yes, MobiKwik is a legal digital payment service provider in India.

Here’s why!!

- Authorization: MobiKwik is an authorized Payment and Settlement System Operator (PSO) under the Payment and Settlement Systems Act of 2007. This implies it follows the Reserve Bank of India’s (RBI) laws and is authorized to offer prepaid instruments such as the MobiKwik Wallet.

- Compliance: MobiKwik follows all applicable RBI rules, including Know Your Customer (KYC) standards and Anti-Money Laundering (AML) requirements. This guarantees that the platform runs legally and responsibly.

- Company Information: MobiKwik is a registered corporation in India with headquarters in Gurgaon, Haryana. Its ownership and operations are transparent and in line with Indian regulations.

- Continued Operations: MobiKwik has been operating in India since 2009 and has faced no legal challenges to its legitimacy. It continues to provide services to millions of people around the country.

As a result, you can be confident that using MobiKwik in India is legal and safe, as long as you respect its terms and conditions and use responsible financial habits.

Is MobiKwik Indian company?

You’re absolutely correct! MobiKwik is an Indian company.

Here’s a recap of its Indian roots:

- Founded in 2009: Established in India by Bipin Preet Singh and Upasana Taku, with headquarters in Gurgaon, Haryana.

- Ownership: Majority-owned by Bipin Preet Singh, an Indian entrepreneur.

- Operations: Focuses solely on the Indian market, offering services like online payments, mobile recharges, bill payments, digital wallets, and financial investments within India.

- Regulations: Operates under the Payment and Settlement Systems Act, 2007, and is authorized by the Reserve Bank of India (RBI).

There was some confusion in the past due to the Indian government’s bans on certain Chinese apps. However, it’s important to remember that MobiKwik has always been an Indian company and is not subject to such restrictions.

So, if you’re looking for an Indian digital payments platform, you can confidently choose MobiKwik.

Is Mobikwik KYC safe?

Whether MobiKwik KYC is completely safe is a complex question with no definitive answer. Here’s what we know:

Safety Measures:

- MobiKwik claims to follow industry-standard security practices, including encryption for storing sensitive data and two-factor authentication for user logins.

- They are certified with PCI DSS, ISO 27001, and adhere to RBI regulations, indicating some level of data security compliance.

Potential Risks:

- Data Breaches: In 2021, there were allegations of a data breach involving MobiKwik, though the company denied any security lapses. This highlights the inherent risk involved in sharing personal information online.

- Government Regulations: The Indian government can access user data in certain situations, raising privacy concerns for some users.

Recommendations:

- Only share the minimum required information: During KYC, provide only the data explicitly required by MobiKwik and avoid sharing any unnecessary personal details.

- Be cautious about third-party links: Avoid clicking on links within KYC emails or messages, as they could be phishing attempts.

- Stay informed: Keep yourself updated on any data breach or security concerns related to MobiKwik.

So, Ultimately, the decision of whether to complete MobiKwik KYC is personal.

Weigh the potential benefits and risks based on your individual needs and comfort level with sharing personal information online.

Remember, there’s no guaranteed “safe” option when it comes to online transactions, and it’s crucial to be cautious and informed.

Is MobiKwik a flipkart company?

MobiKwik is not a Flipkart company.

However, MobiKwik has partnered with Flipkart, along with other e-commerce giants like ixigo and Snapdeal, to enhance digital payment options for users.

This partnership allows MobiKwik to power mobile and utility payments on Flipkart’s platform, expanding its reach and services in the consumer payments sector.

While MobiKwik collaborates with various e-commerce companies, it remains an independent fintech company founded by Bipin Preet Singh and Upasana Taku in 2009.

What is the legal name of MobiKwik?

The legal name of MobiKwik is One Mobikwik System Pvt Ltd, India.

My Social Links: Quora, Facebook, Linkedin, Pinterest, X (Twitter)