Introduction

Which is the best Rupay credit card? Does this question bothers you?

No worries! In this blogpost we will clarify all of your questions lucidly.

In the realm of Indian finance, RuPay credit cards are rising stars, offering lucrative rewards, competitive interest rates, and a focus on domestic transactions.

With a plethora of options available, finding the best RuPay credit card for your needs can feel like navigating a financial labyrinth.

Fear not, fellow spenders! This comprehensive guide will illuminate your path, showcasing the top contenders and empowering you to choose the RuPay card that unlocks maximum rewards and value.

Also Read: Rupay Card Vs Mastercard: Step By Step Comparison

Why Choose a RuPay Credit Card?

Before we delve into the contenders, let’s explore the advantages of RuPay cards:

- Government Initiative: Backed by the Indian government, RuPay cards promote financial inclusion and empower local businesses.

- Lower Transaction Fees: Often boasting lower merchant fees compared to international card networks, this translates to potential savings for both businesses and cardholders.

- Wider Acceptance: Gaining traction rapidly, RuPay cards are now accepted by millions of merchants across India, both online and offline.

- Rewarding Programs: Just like their international counterparts, many RuPay cards offer attractive reward programs, cashback, and other benefits.

Also Read: What is the disadvantage of RuPay? An Eye Opener!

8 Best RuPay Credit Card

Now, let’s break down the top contenders across different categories, considering reward structures, annual fees, eligibility criteria, and overall value proposition:

Best RuPay Credit Card for Online Shoppers

1- HDFC MoneyBack+ RuPay Credit Card

Earn a flat 5% cashback on online spends (capped at Rs. 5,000 per month) and 1% on other transactions. Enjoy a joining fee waiver for the first year with an annual spend of Rs. 1.5 lakh.

2- ICICI Amazon Pay RuPay Credit Card

Get 5% cashback on Amazon India purchases and 2% on other online spends. Benefit from a joining fee waiver with an annual spend of Rs. 3 lakh.

Best RuPay Credit Card for Fuel Spenders

3- IndianOil Axis Bank RuPay Credit Card

Earn 4% cashback on fuel purchases at IndianOil pumps (capped at Rs. 250 per month) and 1% on other spends. This card has a joining fee and annual fee, but you can waive them by meeting spending criteria.

4- IDFC First Power Plus RuPay Select Credit Card

Get up to 6.5% savings on fuel spends at HPCL pumps and various other benefits like complimentary lounge access. However, this card comes with a joining and annual fee.

Best RuPay Credit Card for Travel Enthusiasts

5- SBI Air India Signature RuPay Credit Card

Earn accelerated reward points on Air India spends and complimentary lounge access. This card has a high joining and annual fee, but frequent flyers might find it worthwhile.

6- Federal Bank Yatra RuPay Select Credit Card

Enjoy complimentary domestic airport lounge access and earn reward points on travel spends. This card comes with a joining fee and annual fee, but the travel benefits might offset the cost.

Best RuPay Credit Card for Everyday Rewards

7- Kotak Silk Select RuPay Credit Card

Earn 5% cashback on departmental store and movie spends, and 1% on other transactions. This card has a joining fee and annual fee, but the cashback categories can be appealing for regular shoppers.

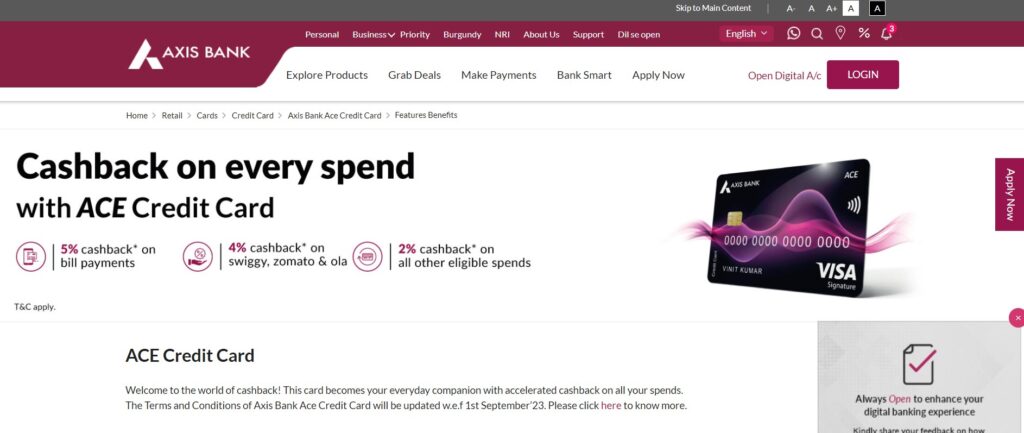

8- Axis Bank Ace Credit Card

Enjoy 2% cashback on all spends with no cap, making it a good option for versatile spending. This card has a joining fee and annual fee, but the no-cap cashback can be advantageous.

Also Read: How To Convert Visa Card To Rupay Card

Tips for Maximizing Your RuPay Rewards Power

- Recognize your spending patterns by looking over your monthly spending to find areas where you may use targeted rewards.

- Pay your bills on time in order to avoid late fees and to keep your credit score high, which will open up further perks.

- Make use of online tools: A lot of RuPay cards come with online gateways for managing accounts, tracking rewards, and redeeming bonuses.

- Compare and switch: Look into new RuPay cards when your needs change or try to work out a better deal with your current provider.

Also Read: P2P Lending In India- A Complete Guide

Conclusion

The best RuPay credit card is subjective and depends on your individual spending habits, lifestyle, and financial goals.

RuPay credit cards are now dynamic choices that support domestic transactions and offer competitive rewards, rather than being niche players.

You may empower your financial path and uncover tremendous value by selecting the proper card and utilizing all of its features.

Discover your ideal match by exploring the RuPay world, and then watch as your rewards skyrocket!

FAQs

Which RuPay credit card is lifetime free in India?

While RuPay boasts several great cards, lifetime free options are limited. Consider HDFC RuPay Shoppers Stop for 6x rewards on their brands and 2x on others, with no annual fee! Otherwise, explore cards with lower annual fees & waive them through spending requirements.

Remember, “free” often comes with trade-offs, so compare features carefully!

Is it safe to link RuPay credit card to UPI?

Yes, Linking your RuPay credit card to UPI is a safe and secure way to make digital payments, offering seamless integration with popular apps like BHIM, PhonePe, Google Pay, and others.

To ensure a secure connection, you’ll need to set up a UPI PIN using your credit card details.

Once linked, you can make payments up to the daily UPI limit or your available credit limit, whichever is lower.

Keep in mind that only RuPay credit cards can be linked to UPI.

Which type of RuPay debit card is best?

Honest Answer is: It depends.

There’s no single “best” RuPay debit card. It depends on your needs! Consider:

- Rewards: Regular shopper? SBI SimplySave gives cashback on bills.

- Travel: Frequent flyer? Axis Miles & More offers flight miles.

- Fees: Student? Check Kotak DigiSprint for low fees and online benefits.

- Benefits: Need insurance or lounge access? Explore premium options like RuPay Select cards.

Compare features & match them to your lifestyle for the perfect fit!

Is RuPay credit card better than visa?

There’s no clear winner!

RuPay cards shine for domestic transactions with lower fees & wider acceptance. Visa offers global reach & diverse card options. Consider:

- Needs: Frequent international travel? Visa might be better. Primarily in India? RuPay could save you money.

- Features: Compare rewards, fees & benefits of specific cards from both networks to find the perfect fit!

Don’t just choose a label, choose the card that serves you best!

Which bank issued RuPay credit card?

RuPay credit cards are issued by various banks in India, offering a domestic payment network with lower processing fees and faster transaction speeds compared to international payment systems like Visa and MasterCard. Some of the banks that issue RuPay credit cards include:

- Union Bank of India

- ICICI Bank

- HDFC Bank

- SBI Card

- Yes Bank

- IDFC First Bank

- Indian Bank

- BoB Bank

- UCO Bank

- Federal Bank

- Axis Bank

- Kotak Mahindra Bank

- RBL Bank

- IndusInd Bank

- South Indian Bank

- Karur Vysya Bank

- City Union Bank

- DCB Bank

- Lakshmi Vilas Bank

- Vijaya Bank

- Syndicate Bank

- Andhra Bank

- Allahabad Bank

- IDBI Bank

- Central Bank of India

- Indian Overseas Bank

- Canara Bank

- Oriental Bank of Commere

- United Bank of India

- Punjab National Bank

- Bank of Baroda

- Dena Bank

- Vijaya Bank

- Corporation Bank

- Andhra Bank

- Indian Bank

- UCO Bank

- Allahabad Bank

- IDBI Bank

- Central Bank of India

- Indian Overseas Bank

- Canara Bank

- Oriental Bank of Commerce

These banks offer a variety of RuPay credit cards with different features, benefits, and eligibility criteria. When choosing the best RuPay credit card, consider factors such as annual fees, rewards, cashback, and insurance coverage to find the option that best suits your needs and lifestyle.

What are the disadvantages of RuPay card?

Please read this detailed article: What is the disadvantage of RuPay? An Eye Opener!

Which RuPay credit card has lounge access?

Several RuPay cards offer lounge access, but it depends on the card tier and bank. Explore “RuPay Select” cards from banks like SBI, PNB, and Federal Bank for complimentary domestic access, while premium cards like SBI Air India Signature RuPay offer international options.

Who is the owner of RuPay?

RuPay is owned by the National Payments Corporation of India (NPCI), which is a not-for-profit organization registered under the Companies Act, 2013.

NPCI was founded in 2008 and is promoted by ten core promoter banks, including State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank N. A., and HSBC

Is RuPay card accepted in Google pay?

Yes, RuPay credit cards are accepted in Google Pay. Users can add their RuPay credit card to Google Pay and make payments seamlessly to merchants across the country.

The feature is available to RuPay credit card holders of Axis Bank, Bank of Baroda, Canara Bank, HDFC Bank, Indian Bank, Kotak Mahindra Bank, Punjab National Bank, and Union Bank of India.

How do I pay my RuPay credit card through GPAY?

To pay your RuPay credit card through Google Pay, follow these steps:

- Open the Google Pay app on your smartphone.

- Go to the Settings menu within the app.

- Tap on “Setup payment method” and select “Add RuPay credit card.”

- Enter the last six digits, expiry date, and PIN of your RuPay credit card.

- Activate the card by setting a unique UPI PIN for your RuPay credit card.

- At the merchant’s payment interface, choose UPI as the payment option.

- Enter the UPI ID or scan the QR code provided by the merchant.

- Confirm the payment amount, enter your UPI PIN, and complete the transaction.

Remember that this feature is available to RuPay credit card holders from banks like Axis Bank, Indian Bank, Bank of Baroda, Canara Bank, HDFC Bank, Punjab National Bank, Kotak Mahindra Bank, and Union Bank of India.

My Social Links: Quora, Facebook, Linkedin, Pinterest, X (Twitter)